Unprofitable Air India Getting $5B From Govt

Struggling, unprofitable state-owned Air India Ltd. is set to receive 300 billion rupees ($5.8 billion) in bailout money from the country's government as it struggles with tough competition and high fuel cost.

US Economic Recovery Done, New Bullish Cycle Ahead: Analyst

The U.S. economic recovery is done, and the economy has begun a cycle domestic consumption-led growth that will differ significantly from the prior cycle that ended in 2008, said Michael Shaoul, chairman of Marketfield Asset Management, a New York investment advisor.

Turnaround Advisor AlixPartners For Sale At $1B-Plus

Turnaround advisor AlixPartners has been put up for sale in a deal that may value the firm at more than $1 billion.

Professors Allege More Accounting Problems At Demand Media

Villanova's Anthony Catanach and Penn State's Edward Ketz say the operator of eHow.com and other sites is overly aggressive with cost capitalization, a method of recording lower expenses for the period in which a cost was incurred.

NY Fed Chief Doubts US Economic Recovery Sustainable

Dudley said strong first-quarter data might have been the result of unseasonably warm weather in much of the United States that pulled forward some economic activity and hiring.

US Trade Deficit Narrowed To $46 Billion In February As Imports Fall

U.S. trade deficit narrowed in February as exports rose slightly to a record while imports fell.

Don't Blindly Buy Dividend-Paying Stocks In 2012

Equity investors are advised to remember that dividends and capital gains or losses matter; one can't embrace the fact some stocks pay high dividends while ignoring their risk to capital.

Amgen To Buy Kai Pharmaceuticals For $315M

Global biopharmaceutical firm Amgen, Inc. (NASDAQ: AMGN) has agreed to buy KAI Pharmaceuticals, a privately held company based in San Francisco, for $315 million in cash.

Unions End Historic Pension Battle With Unilever

Two of the biggest unions representing Unilever employees, Unite and Usdaw, have agreed to end their historic strike against the company, reported the Financial Times.

US Retail Sales Continue To Show Strength

Same-store sales rose 0.5 percent from the previous week and 4.5 percent year on year, the International Council of Shopping Centers and Goldman Sachs reported. Redbook Research said same-store sales were up 0.8 percent from March and 4.1 percent from April 2011.

Economic Momentum Regained In Most Major Countries: OECD

The think tank's composite leading indicators for February showed strong signs of regained momentum in the U.S. and Japanese economies, while Brazil, India, Russia and China showed positive signals compared with the previous month's assessment.

Exiting Euro Could Spark Greek Revival, Doom Germany: HSBC's King

King concedes that quitting the euro zone and reintroducing its drachma currency would likely lead to financial and economic turmoil, but the move would ultimately benefit the Mediterranean country.

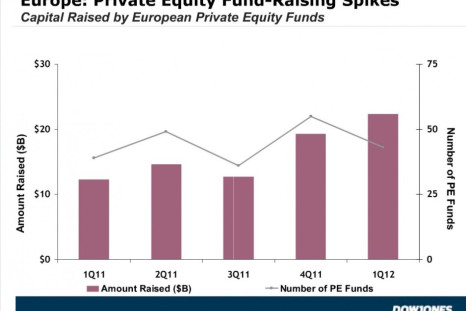

European Private Equity Fund-Raising Surges, Large Firms Dominate

European private equity funds raised 82 percent more capital in the first quarter of 2012 compared to the same period last year, according to Dow Jones LP Source, a research service for the industry.

Euro Zone Breakup Fears Causing Deposit Flight From PIIGS Nations

Fears of a partial breakup of the euro zone are already causing deposit flight from banks in Portugal, Italy, Ireland, Greece and Spain said Jens Nordvig, head of fixed-income research at Nomura Holdings.

AT&T To Sell Struggling Yellow Pages For Nearly $1B

Telecommunications giant AT&T Inc. (NYSE: T) said Monday it will sell a majority stake in its struggling yellow pages business to private equity firm Cerberus Capital Management LP.

US Stock Futures Plunge After Weak Jobs Report

Stock futures on U.S. indexes, which stopped trading at 9:15 a.m. EDT because of the Good Friday holiday, plunged after the Labor Department reported weaker-than-expected jobs numbers for March.

Stock Market Outlook: Barton Biggs Predicts 5%-7% Correction

The head of Traxis Partners still believes U.S. stocks will head higher in coming months, but he's concerned about a near-term pullback as the European debt crisis intensifies and hopes for more Fed bond-buying dim.

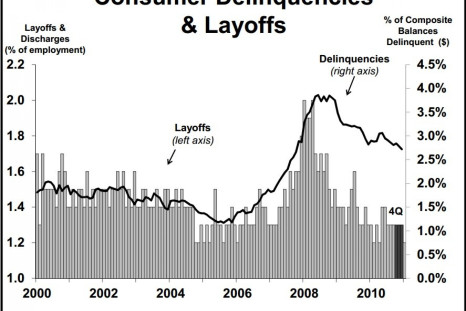

Consumer Loan Delinquency Rates Drop Across the Board

Consumer loan delinquency rates dropped in all 11 categories tracked by the American Bankers Association, ABA, in fourth quarter 2011, a sign that deleveraging has worked and Americans' personal financial situations have become more stable.

Downbeat UK, German Manufacturing Data Add To Recession Fears

A pair of unexpectedly downbeat economic reports from Germany and the UK on Thursday added to fears of a recession in the euro zone and fueled doubts that manufacturing could power the region's economic recovery.

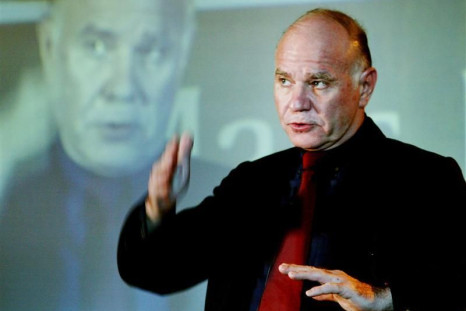

Marc Faber Warns Of Wealth Destruction Via Inflation, Deflation, Unrest

The financial expert and Gloom, Boom & Doom Report publisher predicts a massive loss of wealth sometime down the line, citing unresolved financial excess.

Information-Hungry US Investors Favor Cross-Listed Foreign Stocks

A new Federal Reserve study shows that foreign companies cross-listed on U.S. exchanges receive a disproportionate amount of investment from Americans, mostly because of greater transparency.

US Services Sector Sees Continued But Slower Growth

The U.S. services sector continued to expand in March, although the pace of growth has slowed.

Euro Zone Data Offer Further Signs Of Recession

Fresh figures on business activity and retail sales in the 17-member currency area reinforce earlier signs of recession, even as the European Central Bank left its main interest rate unchanged at an all-time low of 1 percent.

IMF's Lagarde Urges Bold US Action To Bolster Global Recovery

She didn't mention the U.S. central bank's two previous rounds of bond-buying known as quantitative easing, but Lagarde stressed that past action by the Fed and European regulators helped keep growth strong and steady.

Yen Forecast: Xie Sees 40% Drop, Japan Bubble Bursting

Steep depreciation of the Japanese currency is likely before long, the Shanghai-based economist predicts. “A financial bubble doesn't burst slowly. When it occurs, it just pops.

Molson Coors To Buy StarBev, Eyes Eastern European Market

Molson Coors Brewing Company (NYSE: TAP), a North American brewer that owns popular brands like Coors and Molson Canadian, has struck a deal to buy StarBev L.P., a leading Eastern European brewer, in a bid to expand its presence in that region.

SEC Probes Groupon Earnings Report; Long-Time Skeptics Feeling Vindicated

The Securities and Exchange Commission is examining Groupon Inc (NASDAQ: GRPN) for its revision of fourth quarter financial results, reported the Wall Street Journal, citing a person familiar with the situation.

Ngozi Okonjo-Iweala, Not US's Kim, Should Lead World Bank: El-Erian

Ngozi Okonjo-Iweala, finance minister of Nigeria, is gaining favor from several quarters for the presidency of the World Bank over two rival contenders.

FTC Approves $29B Express Scripts, Medco Merger Amid Controversy

The Federal Trade Commission has approved the $29-billion blockbuster merger of Express Scripts, Inc. (NASDAQ: ESRX) and Medco Health Solutions Inc. (NYSE: MHS), two pharmacy benefit managers, or PBMs.

Avon Rejects $10B Bid From Coty; Private Talks Stalled

Avon directors said no to Monday's $23.25-a-share offer from privately held Coty, calling it significantly below multiples [that] an iconic consumer company is worth.