Chicago PMI Remains Above 60, But Some Worried About Oil Prices

The Chicago Purchasing Managers' business barometer, commonly known as the Chicago PMI, for March dropped to 62.2, down from 64.0 in February and below analyst expectations of 63.0.

Euro Zone In Technical Recession: Eurocoin Indicator

The euro zone has fallen into a technical recession, according to Eurocoin, an economic activity indicator, confirming the economic weakness of the battered region.

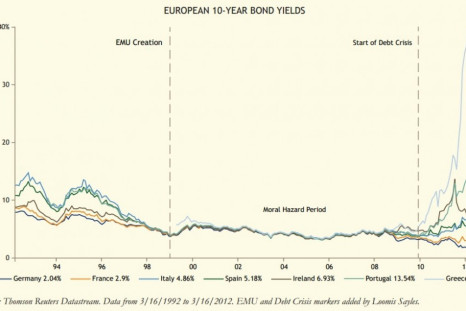

European Financial Crisis Provides Scary Lesson For The World

The perception, driven by bonds' performance, that the euro's success would continue unabated was shattered beginning in October 2009, when Greece’s 10-year yields soared to 10.3 percent. Today, U.S. policymakers may be making the same mistake in failing to recognize threats of a coming financial crisis.

Fukushima Nuclear Plant Operator Asks Govt For $22B More In Aid

The Tokyo Electric Power Company, Inc. (TYO:9501), or Tepco, operator of the failed Fukushima nuclear power plant, has asked the Japanese government for in additional bailout money to pay for mounting expenses, including compensation costs to victims of the nuclear meltdown.

Roche Raises Illumina Bid To $6.5B, Bets On Future of Gene Sequencing

The Swiss pharmaceutical company increased its unsolicited offer for gene-sequencing company Illumina Inc. to $51 a share, 15 percent above Roche's initial bid in January.

AuRico Gold's Profit Rises, Shares Climb

AuRico Gold Inc (NYSE:AUQ), a North American gold producer, reported higher earnings for the fourth quarter and the 2011 year on increased production.

Natural Gas Outlook: Do Super-Low Prices Mean It's Time To Buy?

The long-term view on gas is bright, and experts say now is the time to invest in the commodity. Gas prices have fallen sharply in recent years, to as low as $2.18 per 1 million BTU this year.

Pentair To Merge with Tyco’s Flow Unit Creating $8.9B Entity

Pentair, Inc. (NYSE: PNR), a diversified industrial company, will merge with Tyco International Ltd.'s (NYSE:TYC) flow control business in a deal expected to generate significant savings through synergies, the companies said in a statement.

Italy Has Weak Bond Auction, Spooking Traders

Italy's weak bond auction Tuesday signaled that investors remain concerned about the country and the euro zone region overall.

Abu Dhabi's Mubadala Buys $2B Stake In Empire Of Brazil's Batista

The investment gives Mubadala Development Corp. a 5.63 percent equity interest in Eike Batista's U.S.-based Centennial Asset Brazilian Equity Fund, gaining exposure to the fast-growing Brazilian economy.

Loose US Monetary Policy Scares FPA’s Bob Rodriguez

Bob Rodriguez, CEO of Los Angeles investment firm First Pacific Advisors, fears that loose U.S. money policy could lead to fiscal catastrophes in coming years.

Merkel, Under Pressure, Backs Euro Zone Bailout-Fund Increase

German Chancellor Angela Merkel, previously reluctant to expand the size of euro zone bailout funds, agreed to support a €200 billion ($265 billion) increase of the firewall on Monday.

German Business Confidence Up But Economy Slowing: Ifo

The Ifo Business Climate Index in Germany, a key business confidence report from one of the largest think tanks in the country, showed little change in March from February, indicating the slowdown in recovery.

Are Gold-Mining Stocks The Best Way To Bet On Inflation?

Gold-mining stocks may be the most attractive way for investors to boost their stake in gold, especially if they are concerned about inflation. Investing profitably is not simply a matter of picking an attractive asset -- the asset must also be purchased at an attractive price.

Roche Cuts Cancer Drug Prices In India After Regulators Strip Rival’s Rights

Drugmaker Roche Holdings AG will cut the prices of two major cancer drugs in India after the country’s regulators stripped industry rival Bayer AG of its exclusive rights to market its own cancer drug, reported Reuters, which cited a company spokesperson.

Global Inflation 'Disaster' Coming, Economist Andy Xie Warns

The MIT-trained Xie accurately predicted Japan's asset bubble of the 1980s, the 1997 Asian financial crisis, the deflation of the dot-com bubble and the U.S. subprime mortgage crisis.

Oprah Winfrey Network To Lose $140 Million Amid Ratings Woes: SNL

Oprah Winfrey's cable network could lose $142.9 million this year amid weak ratings for its programming, SNL Financial, a financial information firm, said Thursday.

ConAgra Reports Higher Earnings On Price Hikes

ConAgra Foods Inc. (NYSE: CAG), a major U.S. packaged food giant, reported higher third-quarter earnings as it raised the prices of its products, even as volume softened.

China, Japan To Begin Selling US Treasurys?

China's skein of trade surpluses and Treasury-buying has run its course and the country will need to begin selling some of its vast holdings of U.S. debt, says Frederick Sheehan, ex-head of asset allocation at John Hancock Financial Services.

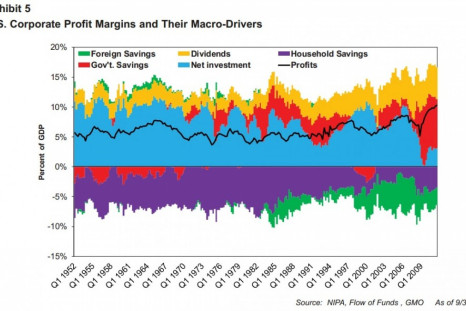

Why Corporate Profit Margins Must Fall [CHART]

It's almost unthinkable that the U.S. government will continue to sustain current levels of spending, and the reduction will lead to diminished profit margins of companies, asset manager James Montier of GMO writes.

H-P To Merge Printer, PC Group, Vyomesh Joshi To Leave Company: Report

Hewlett-Packard plans to combine its imaging and printing operations with its Personal Systems Group, according to technology-news site AllThingsD.

European Stocks Hit By China Growth Worries

Major indexes across Europe were down Tuesday on negative news regarding an expected slowdown in Chinese economic growth.

Greek Default Burden Shifts To European Taxpayers

Some economists predict that if Greece and its European Union partners can't agree on a debt reduction plan, the country may have to default in a disorderly manner and exit the euro currency.

European Financial Crisis: Was ECB’s €500B-Rescue A Bear Stearns Moment?

The European financial crisis has seemingly abated after Greece scored an orderly default on €100 billion ($132 billion) worth of its debt and the European Central Bank (ECB) injected banks with €530 billion in three-year loans.

Misys Accepts $2B Bid, But Some Investors Hope For More

Directors of the U.K. banking-software company accepted a £1.27 billion ($2 billion) cash bid from San Francisco private-equity firm Vista Equity Partners that represents a 6 percent premium to Misys's closing price Friday.

Global Youth Unemployment Rate Staggeringly High: ‘Lost Generation’ Feared

The current, unprecedented level of global youth unemployment has raised the risk of creating a lost generation, Nemat Shafik, deputy managing director of the International Monetary Fund, wrote in a blog post Thursday.

India 2012 Budget Lacks Teeth; Congress Party Is Too Weak To Act

India's budget proposal for 2012, although containing a few welcomed provisions, failed to convince the world that the ruling Indian National Congress party will make meaningful policy changes to tackle the country's structural problems.

Oil Price Is Biggest Risk, Could Spark Global Recession in 2012: Roubini

The prominent economist's main fear isn't the European debt crisis, a hard landing in China or faltering U.S. economic growth but a possible military showdown between Iran and Israel. A war in the Middle East could send oil prices soaring and cause a global recession.

S&P 500 Tops 1,400 As Jobs Market Improves

The S&P 500 Index rallied above 1,400 for the first time since June 2008 on the back of improvements in the U.S. jobs market.

US Double-Dip Recession 2012: ECRI, Roubini Say It’s Coming

In August 2011, famed economist Nouriel Roubini put the probability of a U.S. double-dip recession in 2012 at 60 percent.