U.S. stocks recorded solid performance in the second half of the last year though the early part of the year was jittery. While the Dow Jones Industrial Average rose 11 percent, the Nasdaq Composite gained 17 percent and the Standard & Poor's 500 index rose 13 percent. Where do U.S. stocks go from here? There are analysts who think stocks are poised to show further gains this year.

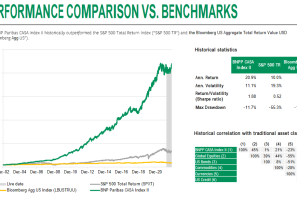

It’s not exactly groundbreaking research, but PIMCO’s Mark Taborsky and Sebastien Page just released a well-constructed chart illustrating the outperformance of the carry trade versus the S&P 500 in the last decade.

Below is the list of earnings from S&P 500 companies relevant to the trading session of Friday, February 11.

Properties underlying Australian commercial mortgage-backed securities (CMBS) experienced minimal disruption as a result of the recent flooding and cyclone experienced in Queensland, Australia, according to Standard & Poor's Ratings Services.

Ratings agency Standard & Poor's downgraded New Jersey bon d rating by one notch to “AA-“ from “AA” (both with stable outlooks).

U.S. stocks advanced in early trade on Monday with the S&P 500 Index gaining 4.88 points, or 0.37 percent, to trade at 1,315.75 at 9:50 a.m. EDT. The Dow Jones Industrial Average advanced 36.63 points, or 0.30 percent, to trade at 12,128.78. The Nasdaq Composite Index gained 0.31 percent.

U.S. stocks, led by insurer Aetna, finished the day strong amid a conflicting U.S. jobs report from the Dept. of Labor.

Dow and S&P 500 are down slightly today, as investors struggled to interperet the January jobs report from the U.S. Dept. of Labor

U.S. stocks, after selling-off in the early session, bounced back to finish moderately higher on some positive economic news, despite continued political unrest in Egypt.

Retail clothing stores such as Ann Taylor are leading the way so far on strong retail report by the Institute for Supply Management

ThinkEquity has outlined its top technology stock picks for 2011. The stocks include AMD, Spansion, Entropic, Micron Technology, Nvidia, Aruba Networks, Mellanox, Stec, Google and Priceline.

The Dow Jones Industrial Average and S&P 500 finished above 12,000 and 1,300 points, resepctively, for the first time since mid-2008.

U.S. stocks, led by Pfizer and Bank of America, surge.

Exxon, IBM, Alcoa lead strong day for U.S. stocks

Dow Jones Index was up 21.99 points, or 0.19 percent, to 11,845.69 and the S&P 500 index rose 4.54 points, or 0.36 percent, to trade at 1,280.88. Meanwhile, Nasdaq gained 0.39 points, or 0.01 percent, to 2,687.28.

Moody's has downgraded Egypt's government bond ratings to Ba2 from Ba1 and has cut the outlook to negative from stable.

Earnings reports and acquisition announcements took a back seat to the violent unrest in Egypt today, as U.S. stocks fall.

Despite Verizon's announced intention to acquire Terremark for $1.4 billion, are down virtually across across the board amid violent uprisings in Middle East.

The China Gold Association estimates... that the demand for gold in the first half of the year will rise by 15 percent year on year, citing growing demand for alternative investments and protection against inflation, said Commerzbank in a note.

The S&P 500 broke the 1,300-point threshold for the first time since August, 2008 as gold plummeted and U.S. stocks rose slightly.

Dow once again briefly surpassed 12,000 points as stocks rose slightly on strong earnings reports.

Gold priced in yen rallied to session highs on Thursday after yen came under broad pressure following a downgrade to Japan' sovereign ratings. Ratings agency Standard & Poor's cut its rating on Japan's sovereign debt to AA- from AA ...