Gold prices held steady Friday as investors stood on the sidelines ahead of a key U.S. payrolls report due later in the day

Manufacturing unexpectedly grew in August and fewer Americans filed new claims for jobless aid last week despite a slump in confidence that threatened to push the economy back into recession.

Kenya's interbank lending rate tumbled to 19.2515 percent on Tuesday from 27.7299 percent the previous day, central bank data showed on Thursday, as the bank's action last week to bring down interbank rates filters through the market.

Manufacturing unexpectedly grew in August and fewer Americans filed new claims for jobless aid last week, despite a slump in confidence that threatened to push the economy back into recession.

Should the United States tolerate slightly higher inflation, in order to have the economy grow at a faster rate and create more jobs?

Slumping export demand slowed factory activity in some of Asia's biggest economies in August, although China fared better thanks to solid domestic growth, a series of surveys released on Thursday showed.

Chinese liquor maker Wuliangye will raise prices for its alcohol by 20-30 percent from Sept 10, the firm said, the latest company to lift retail prices amid stubborn inflation pressures.

Gold and silver prices closed modestly higher on the futures markets Wednesday as strong demand from foreign buyers offset expectations that the Federal Reserve will signal fresh, potentially inflationary, intervention in the market next month.

Gold fell on Wednesday after a near 3 percent rally the day before sparked by Federal Reserve comments on possible measures to boost U.S. growth, and the bullion price is still set for its biggest monthly gain in nearly two years.

The U.S. Federal Reserve could embark on a third round of quantitative easing depending on upcoming economic data but should first confirm that inflation has eased, a senior Fed official said in the Asahi newspaper on Wednesday.

The latest Fed minutes show is that the central bank is well aware that the U.S. economic recovery is underperforming -- it's like a car traveling in the right lane on an interstate highway at 40 miles per hour (barely adequate) -- and it's prepared to take additional action to strengthen the recovery, should the tepid growth conditions continue.

Confidence among consumers plunged in August to its lowest in more than two years following the country's loss of its top credit rating and heart-wrenching drops in major stock indexes.

Consumer confidence crumbled in August to its lowest level in more than two years as the fallout from political wrangling over a budget deal took its toll, according to a private sector report released on Tuesday.

Even PIMCO's Bill Gross makes a wrong call every now and then. Gross, manager of the world's largest bond fund noted for calling the housing bubble early on that burst several years ago, feels like crying in his beer for betting so heavily against U.S. government related debt this year.

Gold regained strength on Tuesday as bargain hunting resurfaced after prices dropped more than 2 percent in the previous session, but higher equities and easing worries about recession in the United States could limit gains.

Euro zone economic sentiment fell more than expected in August, underlining prospects for slower economic growth and expectations that the European Central Bank may cut inflation forecasts and cease raising interest rates.

Gold regained strength Tuesday as bargain hunting resurfaced after prices dropped more than 2 percent in the previous session, but higher equities and easing U.S. recession fears could limit gains.

India's economy probably grew an annual 7.6 percent in the quarter through June, slowing from the previous quarter's 7.8 percent growth, the median forecast from a poll of 28 economists showed

China's central bankers have found a new way of keeping banks from lending too much, a step Beijing hopes will help it tackle the country's persistent inflation woes.

Figuring out what the People's Bank of China is doing can be as perplexing as parsing a statement from Alan Greenspan, the notoriously opaque former U.S. Federal Reserve chairman.

Recent strikes in Indonesia by gold miners, pilots and supermarket staff over pay signal that workers have started to push for a greater share of profits in a booming economy that has drawn foreign investors partly for its low labor costs.

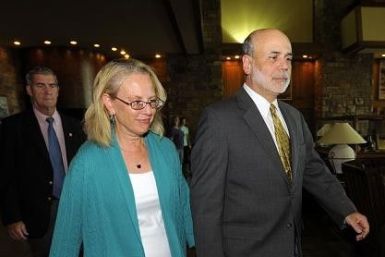

World stocks rose 1 percent and the dollar fell on Friday as Federal Reserve Chairman Ben Bernanke left the door open for future U.S. economic stimulus.