Futures on the major U.S. indices point to a higher opening Wednesday ahead of a report on the Federal Reserve's Beige Book and the European Central Bank's (ECB) monthly rate-setting meeting.

Futures on major U.S. indices point to a slightly higher opening Tuesday ahead of the nonmanufacturing composite index report, as well as a teleconference among G7 leaders.

Brazil's oil regulator announced Monday it could affix a fine Chevron Corp., would have to pay for a November oil spill off the coast of Rio de Janeiro by this summer.

Futures on major U.S. indices point to a lower opening Monday ahead of the U.S. Dept. of Commerce's Report on Manufacturers' Shipments, Inventories and Orders, and increasing concerns over the euro zone crisis.

Spanish Prime Minister Mariano Rajoy proposed on Saturday that the 17 countries in the euro zone create a common fiscal authority, with each surrendering a significant amount of its national sovereignty to send a signal to financial markets about the certainty of their single-currency experiment.

Two-plus years after the so-called Flash Crash wreaked havoc in the U.S. equity market on May 6, 2010, the Securities and Exchange Commission announced Friday it has OK'd two proposals designed to dampen extraordinary volatility in individual securities and the broader stock market.

With the Institute for Supply Management's manufacturing report and the U.S. Bureau of Labor Statistics' Employment Situation Summary both weaker than analysts' consensus estimates on Friday, U.S. stocks closed a holiday-shortened trading week by dropping like so many hot pennies scattered in cold snow.

A shockingly weak jobs report hammered U.S. equities Friday, as major stock indexes headed for their worst loss of the year and erased all of their 2012 gains.

Shares of big gold mining companies rocketed higher Friday as the yellow metal regained its status as a safe-haven amid growing fear that the American economy may not be able to offset the combined drag of the euro zone crisis and sharply decelerating growth in China and India.

U.S. stocks followed global equities down Friday as fears mount that the American economy may not be able to offset the combined drag of the euro zone crisis and sharply decelerating growth in China and India.

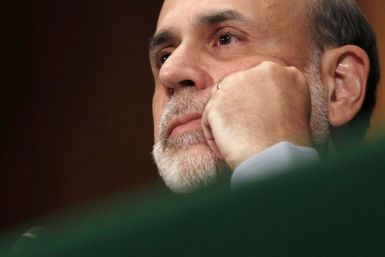

A third straight month of disappointing job data clearly suggests that the U.S. labor market conditions are deteriorating again, which economists say will undoubtedly prompt more speculation that a third round of quantitative easing by the U.S. Federal Reserve is coming soon.

U.S. stock futures plunged Friday after a surprisingly weak nonfarm payrolls report raised fears that the nation's nascent recovery may be losing steam and raising the possibility that the Federal Reserve may opt for economic stimulus measures.

Futures on major U.S. indices point to a lower opening Friday ahead of the anticipated Bureau of Labor Statistics' Nonfarm Payrolls report, the Institute of Supply Management (ISM)'s Manufacturing Purchasing Managers Index (PMI) report, and ADP's Personal Income report.

The Dow Jones Industrial Average fell 26 points Thursday to 12,393 -- pushed lower by sentiment that May's U.S. Non-Farm Payroll reportl, to be released Friday, will be tepid.

The value of the monetary unit of China dropped against the world's reserve currency on Tuesday

Futures on major U.S. indices point to a higher opening Thursday, ahead of the ADP National Employment Report and the Bureau of Labor Statistics' (BLS) report on Initial Jobless Claims.

Asian markets fell Thursday as concerns over the debt crisis looming over the euro zone increased due to heightened Spanish banking sector woes.

Japan's industrial production gained in April from the previous month but remained below expectation, raising concerns about the country's faltering economic growth momentum.

Iraqi officials on Tuesday said their country's next oil lease auction will not allow companies to sign contracts with Iraq's semi-autonomous northern region of Kurdistan.

Futures on major U.S. indices point to a lower opening Wednesday ahead of anticipated reports on the Mortgage Applications Index and Pending Home Sales.

The value of the Canadian dollar gained against most of its rival currencies Tuesday amid strong indications of growth in Asia and North America

European stocks recovered from early losses Tuesday as traders anticipate the U.S. data to show improving consumer confidence and a stabilizing housing market. Meanwhile, Asian equities rallied for a second straight day on hopes that China may introduce further stimulus policy. U.S. index futures rose.