The president of the Federal Reserve Bank of San Francisco said Wednesday the Fed may resume expanding its balance sheet to boost the U.S. economy if the recovery loses momentum or inflation stays below two percent.

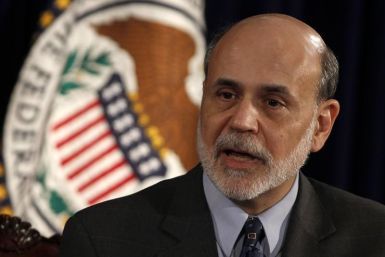

Federal Reserve Chairman Ben Bernanke on Tuesday renewed a pledge to prevent Europe's financial crisis from damaging the U.S. economy in testimony before Congress that mirrored remarks he made last week.

U.S. borrowers tacked on $19.6 billion in revolving -- mostly credit card-related -- debt in December, according to preliminary data from the Federal Reserve. Non-revolving credit was also up. Borrowing grew across all categories -- be it charges on commercial credit cards, student promissory notes, auto loans of fixed-term mortgages.

Former United States President George W. Bush defended the emergency bailout funds his administration provided to General Motors Co. and Chrysler Group LLC in a speech to car dealers Monday, saying he would do it again.

Federal Reserve Chairman Ben Bernanke on Tuesday warned Congress that putting off a decision on the fate of expiring Bush administration tax cuts could unsettle businesses and households, undercutting the U.S. economic recovery.

The chairman of the Securities and Exchange Commission is eyeing two potential plans to bolster the stability of money market funds, but their fate remains uncertain due to internal disagreement at the SEC over the need for more regulations.

Below are highlights from Federal Reserve Chairman Ben Bernanke's testimony on Tuesday on the state of the U.S. economy to the Senate Budget Committee. Bernanke's prepared testimony was virtually identical to testimony on Thursday to the House Budget Committee.

Gold prices rose 1 percent on Tuesday as expectations that a Greek rescue deal will be completed drove the dollar down sharplyagainst the euro.

Federal Reserve Chairman Ben Bernanke held his policy prescription cards close to his vest Tuesday morning, skirting around several questions from Senate Banking Committee members that seemed designed to pigeonhole the central bank chief into supporting ideologically-charged positions. At the same time, the top U.S. central banker was effusive in his defense of the Federal Reserve's expansionary monetary policy.

Federal Reserve Chairman Ben Bernanke on Tuesday renewed a pledge to prevent Europe's financial crisis from damaging the U.S. economy in testimony before Congress that mirrored remarks he made last week.

The domestic economic evidence in the U.S. has remained upbeat in early 2012, with a much better than expected employment report for January being the latest piece of good news according to the report by IHS Global Insight.

The shock to the U.S. economy after the housing bubble burst in 2008 was like an earthquake which has left one part of the land higher than another part, Federal Reserve Bank of St. Louis President James Bullard said, in a somewhat critical note on the actions of the U.S. central bank.

Gold prices declined Monday on concerns Greece will - despite the Eurozone's two years of efforts - default on its massive sovereign debt, with acute consequences for global economic growth.

Japan's Nikkei share average advanced to a three-month high on Monday as the U.S. economy showed further improvement with forecast-beating jobs data, boosting hopes for Japanese firms, which have disappointed in the latest quarterly earnings season.

Asian shares rose Monday as surprisingly robust U.S. jobs data bolstered investor risk appetite, overshadowing worries about a lack of progress in Greek debt restructuring talks that are vital to containing the euro zone debt crisis.

A renewed focus on Europe's banking and debt crisis may quickly sap the nascent optimism about global economic prospects that followed a remarkably solid U.S. January employment report.

The United States is coming to be seen as a global threat, acting unilaterally with aggressive new market rules that critics say will hurt U.S. firms, foreign banks, and international markets in one swoop.

Gold fell 1 percent on Friday, its biggest one-day loss in over a month, after encouraging U.S. payrolls data smashed hopes of extra stimulus from the Federal Reserve, which had been priced into bullion's recent rally.

Hiring in the U.S. accelerated in January for a third month and the jobless rate fell unexpectedly to the lowest point in almost three years, signaling the labor market is gaining momentum.

The economy created jobs at the fastest pace in nine months in January and the unemployment rate dropped to a near three-year low of 8.3 percent, indicating last quarter's growth carried into early 2012.

Gold prices held steady on Friday, on course for a fifth straight week of gains, as investors awaited a key U.S. labor market report after upbeat jobless claims data in the previous session helped send bullion to a two-month high.

Asian shares and the euro fell on Friday as debt restructuring talks between Greece and its creditors dragged on, undermining sentiment, and investors sat tight ahead of U.S. jobs data that will offer more clues on the health of the world's top economy.