Gold extended its gains on Tuesday after the Federal Reserve said it would keep interest rates low for at least another two years to help a U.S. economy that is growing considerably weaker than expected.

In response to a slowing economy, the U.S. Federal Reserve, despite some internal dissent, announced Tuesday that it plans to keep monetary policy stimulus in place, noting that it will keep short-term interests rates exceptionally low through at least mid-2013. The Fed will also continue to reinvest bond proceeds maturing in its portfolio.

The Dow advanced slightly Tuesday after the Fed pledged to keep its benchmark interest rate at a record low through at least mid-2013.

Federal Reserve policymakers began meeting on Tuesday under growing pressure to take some type of action to stem a financial market meltdown linked to fears of a new U.S. recession.

The U.S. stock market soared ahead of the Federal Open Market Committee (FOMC) statement after a brutal session on Monday.

The S&P downgrade is already old news for U.S. markets. All eyes are on the Fed, and concerns about slow growth and the real threat of a new recession.

U.S. markets were poised to open higher Tuesday as futures rose based on anticipated action from the Fed.

Stock index futures rose on Tuesday, indicating a partial rebound from the previous session's nosedive, as investors looked to a Federal Reserve statement for clues on how it may combat the growing perception the nation was headed for recession.

The Swiss franc hovered near record highs against the dollar and euro in Asia on Tuesday, having surged on the back of a global stock market rout as a crisis of confidence gripped investors.

Low-wage jobs play an outsize role in powering Texas' economic engine

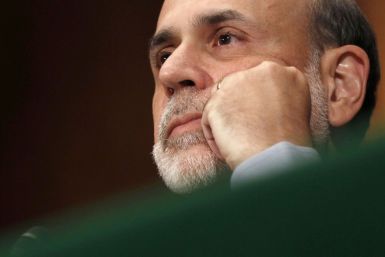

The U.S. Federal Reserve will announce its monetary policy Tuesday following an unprecedented downgrade of the U.S.Government's credit rating by Standard & Poor's and the markets will likely look to Fed Chairman Ben Bernanke to provide appropriate comments on the state of the nation's banking system and its fiscal condition.

After considering a resignation once a debt deal was reached, U.S. Treasury Secretary Timothy Geithner confirmed on Sunday that he will remain at his post at President Barack Obama's request, making him Obama's longest-serving economic adviser after the first-ever U.S. credit downgrade.

Japan's Nikkei stock average slid more than 2 percent on Monday as weak sentiment following Standard & Poor's downgrade of the United States' credit rating was exacerbated by futures selling after Asian markets tumbled.

All the three rating agencies -- Moody's, Fitch and S&P - have warned the current Administration that if things weren't done to curtail the tide of out-of-control spending and poor fiscal and monetary policies they would be forced to review the credit rating of the U.S. for possible downgrade.

Treasury Secretary Timothy Geithner, who had considered stepping down after the government borrowing limit was raised, confirmed on Sunday that he will remain at his post at President Barack Obama's request.

The European Central Bank stepped into bond markets on Monday, backing up a pledge to support Spain and Italy with the aim of averting financial meltdown in the euro zone, while the G7 and G20 offered soothing words to investors shaken by a historic downgrade of the U.S. debt rating.

A downgrade of United States' top-tier credit rating has Wall Street scrambling to figure out the knock-on effects for the financial system, from mortgages to banks to markets that rely on U.S. Treasuries for collateral.

The United States lost its top-tier AAA credit rating from Standard & Poor's on Friday, a move that will affect the country's borrowing costs and investor opinion of U.S. assets. Here is a Q+A on what the downgrade means for investors, consumers and to the country.

China roundly condemned the United States for its "debt addiction" and "short sighted" political wrangling and said the world needed a new stable global reserve currency.

In a stunning development, Standard & Poor?s Friday downgraded the U.S. Government's credit rating from AAA to AA+, arguing Washington has made inadequate progress cutting the budget deficit. The U.S. Treasury disagrees with S&P?s analysis and conclusion, but interest rates on U.S. home mortgages and car loans are likely to rise.

U.S. consumer credit borrowing in June jumped to highest numbers since August 2007, the Federal Reserve announced today.

One of the world's leading economists says don't get giddy over the July jobs report, which indicated the U.S. economy created a better-than-expected 117,000 jobs. NYU Professor Nouriel "Dr. Doom" Roubini, who accurately predicted the housing crisis four years ago, says U.S. GDP will be sub-par in 2011 and the risk of a recession is real.