U.S. existing home sales unexpectedly fell in June, according to the National Association of Realtors, raising fresh doubts about the housing recovery. Here are five important trends taken from the numbers.

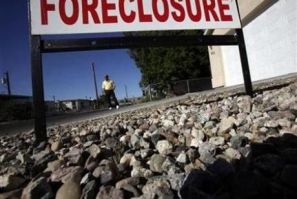

The recession and housing crash have triggered a sharp decline in the share of American households who own their own home. Homeownership, which is at its lowest point in 15 years, is bound to fall even further, driven by tight credit, lackluster economic growth and more foreclosures.

California, the state with the second most foreclosures by volume, has passed one of the strongest laws in the country seeking to protect homeowners from improperly losing their homes.

Sun-drenched Arizona became a poster child for the overdevelopment excesses of the boom, but it's recently become a leader in the U.S.'s long-awaited housing recovery.

U.S. home prices rose 2 percent in May, another sign that the depressed housing market is stabilizing, data firm CoreLogic (NYSE: CLGX) said Monday.

North Las Vegas was the fastest-growing large city in the United States five years ago, but now it's facing a more than $30 million budget gap and has declared a state of emergency.

U.S. foreclosure filings increased for the first time in three months by 9 percent in May, according to a Thursday report by listings site RealtyTrac.

Anarchists have been arrested for a spate of bomb attacks in Italy, and are being blamed for violence in Europe and the U.S. Is this the comeback of a movement that was considered a big threat a century ago?

JPMorgan Chase & Co Chief Executive Jamie Dimon defended the intent of the portfolio behind the bank's recent multibillion-dollar trading loss, telling lawmakers it was a genuine hedge that would make the firm a lot of money if a credit crisis hit.

Protestors were present on Wednesday, June 13, when JPMorgan Chase chief executive Jamie Dimon testified on Capitol Hill in Washington. The activists reportedly heckled Dimon as the head of the largest bank in the U.S arrived to take his seat at a Senate Banking Committee hearing.

U.S. President Barack Obama on Saturday continued to urge Congress to pass legislation he said would add more jobs for teachers as Republicans and Democrats bickered over whether expanding the public sector would strengthen the economy.

Mitt Romney would not offer relief for the 11.5 million U.S. homeowners with underwater mortgages if he were elected president, one of his advisers said Saturday. The assertion contrasts with Romney's own words in January: The idea that somehow this is going to cure itself by itself is probably not real.

U.S. home resales rose in April to their highest annual rate in nearly two years and a falloff in foreclosures pushed prices higher, hopeful signs for the country's economic recovery.

The annual shareholder's meeting Tuesday of JPMorgan Chase & Co. (NYSE: JPM), widely expected to feature fiery denunciations of leaders at the nation's biggest bank, could hardly have been quieter or more management-friendly.

Demonstrators are expected to swarm Bank of America Corp's annual shareholder meeting on Wednesday to voice anger over a range of issues from foreclosures to corporate taxes to financing for the coal industry.

The number of blacks and Hispanics registered to vote has dropped precipitously since the 2008 election, diminishing two bastions of Democratic support that could prove crucial in what promises to be a tight presidential race.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.84 percent in the week ending May 2, following subdued economic data, mortgage financier Freddie Mac said Thursday.

The share of privately-owned U.S. homes fell to a 15-year low in the first quarter as falling house prices and stringent lending conditions push younger Americans, in particular, into renting.

Sales of new U.S. homes fell to a seasonally adjusted annual rate of 328,000 in March, the Commerce Department said Tuesday, but beat expectations by analysts.

The American market for single-family homes fell to new lows in February, but prices declined at a slower rate compared to the previous month, a private report showed Tuesday, as the housing market continues to struggle.

U.S. existing home sales fell 2.6 percent in March to an annual rate of 4.48 million, the National Association of Realtors said Thursday, missing expectations and highlighting continued weakness in the housing market.

The foreclosure activity in the US for the first quarter declined to the lowest level since the fourth quarter of 2007, according to a report by RealtyTrac.