There were signs of improvement in U.S. housing data released in February, but warmer weather could have been as much of a factor as strengthening market fundamentals, according to industry experts.

Construction spending fell 0.1 percent in January compared to the previous month, the first drop since July, as the commercial and government sectors contracted, the U.S. Commerce Department said Thursday.

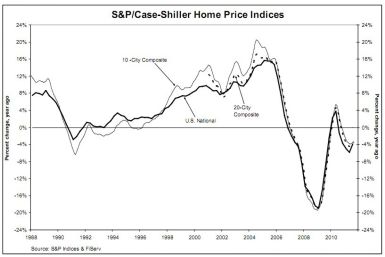

U.S. home prices hit their lowest level since subprime mortgages began imploding in mid-2006, with 20 metro regions falling 3.9 percent in December compared to the prior year, according S&P/Case-Shiller Home Price Index data released Tuesday.

The S&P/Case-Shiller Housing Index is expected to show further price erosion throughout the country when figures are released on Feb. 28, according to analysts and housing experts.

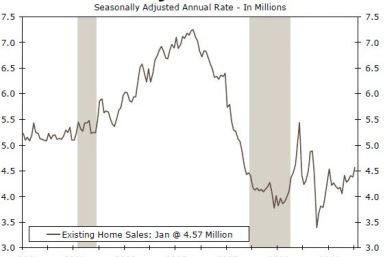

U.S. home resales rose to a 1-1/2 year high in January, pushing the supply of properties on the market to the lowest level in almost seven years in a hopeful sign for the housing sector.

Sales of existing U.S. homes rose 4.3 percent to 4.57 million in January, up from a revised 4.38 million in December, according to the National Assocation of Realtors, marking further improvement in the housing market as interest rates remained low and the job market saw gains.

Existing home sales are expected to rise in January as the broader economy improves, according to analysts and industry experts.

A report this week showing rampant foreclosure abuse in San Francisco reflects similar levels of lender fraud and faulty documentation across the United States, say experts and officials who have done studies in other parts of the country.

Real estate appraiser Jonathan Miller disagrees with NAR's prediction of low housing inventory resulting in rising (or at least stabilizing) prices, claiming that it merely reflects a slowdown in foreclosures that will be reversed with the robo-signing agreement.

A source has told American Banker that the terms of this week's massive national mortgage servicing settlement have not been finalized, and that politics drove Thursday's announcement

The head of the U.S. central bank, in his second public statement on housing policy in as many weeks, told an audience of residential builders Friday that creditors who own vacant homes should consider renting the properties as a way to stanch urban blight.

Negotiations on both sides of the Atlantic Ocean, between Greece and its lenders and between big U.S. banks and the federal government, boosted the willingness of investors Thursday to move into risk assets, many of which posted gains.

Officials Thursday detailed a nationwide settlement with five large banks over foreclosure practices. Negotiators defended the deal as a way to give immediate relief to homeowners and victims of foreclosure abuses.

Nearly 1 million U.S. homeowners have won permanent reductions on mortgage payments since the Obama administration launched its foreclosure prevention program in 2009, the U.S. Treasury said on Monday, only a fraction of the total it aimed to reach.

Are you living in misery in one of America’s most miserable cities?

Donald Trump officially endorsed Mitt Romney for president on Thursday, praising the Republican front-runner for his business sense and stance on foreign policy.

President Barack Obama called on Wednesday for an expanded homeowner refinance program that would lift restrictions for more borrowers, representing another government effort to aid the ailing housing market.

Mitt Romney cemented his front-runner status with his Florida 2012 primary win Tuesday night, coming ahead of Newt Gingrich with almost half of the vote.

U.S. home prices are expected to continue to fall in S&P/Case-Shiller Housing Index data through November 2011, to be released on Tuesday, Jan. 31.

U.S. taxpayers are still owed $132.9 billion by companies that benefited from the financial bailout and haven't fully repaid. Some of that money will never be recovered, a government watchdog said. Christy Romero, the acting special inspector general for the $700 billion bailout, has said the bailout that began in September of 2008, could actually last for several more years.

As state and federal officials near a deal with top banks to settle claims of foreclosure abuses, left-leaning activist groups have stepped up pressure on the officials to reach a deal that demands more from the banks.

Bill Weir, the co-anchor of ABC's Nightline, made a shocking discovery while working on a story about full body scans this week: he himself is at major risk of having a heart attack. Weir's on-air diagnosis is very rare, but he's not the only reporter whose assignment has turned intensely personal: three other reporters have all saved lives with their coverage, and for two of them, their reasons were intensely personal.