Top-tier technology companies including Hewlett-Packard (NYSE: HPQ), IBM (NYSE: IBM), Intel (Nasdaq: INTC), Qualcomm (Nasdaq: QCOM) and Applied Materials (Nasdaq: AMAT), among others, all buy back shares. Qualcomm and Applied Materials have just refreshed their buyback programs and hiked their dividends, too.

Shares of IBM set a new high of $201.57 after new CEO Virginia Rometty said the No. 2 computer services company was “uniquely positioned” to deliver benefits of “a gusher of data” flowing into the global economy.

Mark Twain would have been amused by the remarks of new Apple Inc. (Nasdaq: AAPL) CEO Tim Cook last week when he announced the post-PC era. As Twain observed after reading his obituary, The report of my death was an exaggeration.

Shares of IBM (NYSE: IBM) are above $200 for only the second time in the No. 2 computer company’s 101-year history, valuing it at $232.4 billion.

The global PC market should expand 4.4 percent in 2012, greatly exceeding 2011’s anemic 0.5 percent, gain market researcher Gartner (NYSE: IT) predicted.

It's finally here... and the new iPad, as Tim Cook referred to it (neither an iPad 3 nor a 2S) sports a stunning display and an array of spellbinding features that will silent Android competitors like Samsung and Amazon for quite some time.

Will big companies like IBM or venture capital-backed companies ensure the technology future of the U.S?

Janus Capital Group cut the pay of its chief executive sharply last year and put new compensation guidelines in place after it lost a shareholder "Say on Pay" vote, the Denver asset manager said in a proxy filing on Thursday.

Dell Inc launched a new line of servers for enterprise customers, boosting its corporate business unit and shifting its focus further away from consumers, who are increasingly choosing such devices as Apple Inc's iPad.

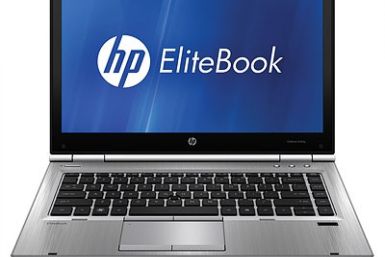

Five months into her tenure, is new Hewlett-Packard CEO Meg Whitman really up to the job? Chances are no and the indications she gave last week are that she may never measure up.

Shares of Hewlett-Packard Co fell more than 7 percent Thursday, after the world's No. 1 computer maker posted a sharp decline in quarterly earnings and warned it would take several years to turn around its sprawling businesses.

Shares of Hewlett-Packard (NYSE: HPQ), the world’s biggest computer company, fell as much as 7 percent Thursday after the company reported first-quarter earnings that beat expectations but issued a mediocre earnings forecast.

Shares of Hewlett-Packard, the world’s biggest computer company, will likely fall Thursday after the company reported first-quarter earnings that beat expectations but issued a mediocre earnings forecast.

Hewlett-Packard reported Wednesday that net income fell sharply for the first fiscal quarter and warned of continued weakness as it was losing market share in personal computers and printer business.

Hewlett-Packard and Dell Inc are keeping a close eye on a big jump in wages for workers that assemble Apple Inc's iPhone in China, and could be forced to nudge up prices for their own products if labor costs keep rising.

Hewlett-Packard Co's earnings fell nearly 44 percent and the world's No. 1 computer maker forecast a second-quarter profit below Wall Street estimates as it struggles with weak sales of PCs and printers.

Hewlett-Packard Co's earnings fell nearly 44 percent and the world's No. 1 computer maker forecast a second-quarter profit below Wall Street estimates as it struggles with weak sales of PCs and printers.

Hewlett-Packard, the world’s biggest computer company, reported first-quarter earnings that beat expectations as higher margin products sold more strongly than expected.

Shares of Hewlett-Packard, the No. 1 computer services company, have gained more than 12 percent this year and nearly 30 percent since new CEO Meg Whitman was installed in September.

Apple will retain more than 50 percent of the market past 2015 according to projections from a recent TrendForce report. The company is expected to control 59.3 percent of the tablet market share in 2015.

Shares of Dell, the No. 3 PC maker, fell more than 5 percent Wednesday after the company reported earnings below estimates and issued a dismal forecast.

Shares of Dell, the No. 3 PC maker, look likely to fall sharply Wednesday after the company reported earnings below estimates and issued a dismal forecast.