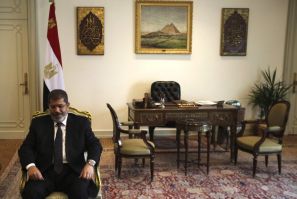

The Egyptian government Wednesday sought a $4.8-billion loan from the International Monetary Fund to help boost the country's economy struggling to recover from a political turmoil since last year's uprising that led to the fall of President Hosni Mubarak.

China's manufacturing activity fell in August compared to that in July, according to the preliminary HSBC Flash Purchasing Managers Index released Thursday.

Both Juncker and German Chancellor Angela Merkel, who Samaras will meet on Friday, are under enormous political pressure to act tough with Greece and are expected to offer little room for renegotiation.

Hungary's best and brightest are feeling pinched by an increasingly demanding government.

Investors rewarded Portugal's efforts to trim its budget gap by sending the credit-default swaps on Portugal to a low of 725 basis points on Thursday, down from 1,515 in January and 1,237 in May, according to Bloomberg. The implied probability of Portugal defaulting on its debt fell to 46 percent from 73 percent.

Asian markets gained this week on buoyed investor confidence with indications of an improving U.S. economy and the hopes of an announcement of stimulus measures by China to regain the economic growth momentum.

With China’s economy continuing to slowdown in 2012 market participants feel it is imperative that stimulus measures be implemented to regain the growth momentum.

China's manufacturing activity grew at a slower pace in July compared to that in the previous month, increasing concerns over a slowdown in the economic growth of the country.

While Greece awaits the latest round of bailout cash from international lenders, the country is fast approaching a new payment deadline and has until the end of August to repay a ?3.2 billion ($2.6 billion) bond or face the catastrophic consequences of defaulting on its debts.

Most of the Asian markets fell in the week following the revival of the investor concerns about the deepening debt burden faced by the euro zone and worsening global economic growth.

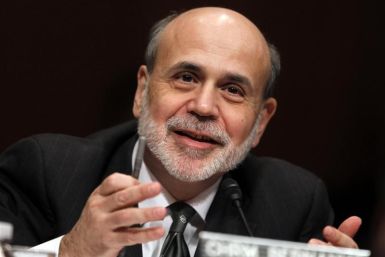

Next week could see some major worldwide financial implications, depending on what three of the world's largest central banks do at their scheduled meetings.

Japan’s retail sales growth slowed down in June as compared to May, indicating that private consumption being affected by the faltering global economic conditions.

The Spanish crisis, last week’s German vote, talk of a possible withholding of funds for Greece, and now the downgrading of the credit outlook for Europe’s strongest economies, point to a worsening of the financial crisis, a reduction in support for the euro, and a global economy increasing at risk.

Asian stock markets advanced for the first time in five days on Thursday as disappointing U.S. housing data boosted hopes for further monetary stimulus from the Federal Reserve.

Sudan must press ahead with reforms to ensure its economic stability, an International Monetary Fund mission said on Wednesday, while welcoming the country's recent moves including scaling back its fuel subsidies and devaluing its currency.

The U.S. stock index futures pointed to a lower opening Wednesday as investor confidence continued to be dragged down with no resolution to the euro zone crisis visible on the horizon.

U.S. stock index futures point to a flat opening Tuesday as investor sentiment continue to be affected by the mounting borrowing costs faced by Spain and worsening economic condition of Greece.

Most European markets rose Tuesday but investors remained watchful amid continuing concerns of the deepening economic conditions in the euro zone.

China's manufacturing activity rose in July compared to that in June, according to the preliminary HSBC Flash Purchasing Managers Index (PMI) released Tuesday.

Representatives of the creditors that are keeping Greece economically afloat are set to arrive in Athens Tuesday to appraise Greece's slow progress in implementing austerity measures required for it to continue to receive bailout money.

In a fairly light week of data, Friday's first take on the U.S. second-quarter gross domestic product will be the main event. Economists expect a feeble reading of 1.4 percent. This will be the final major data point to influence participants at the July 31 - Aug.1 meeting of the policy-setting Federal Open Market Committee.

Asian stock markets slumped Monday as renewed concerns over the euro zone debt crisis and worries about the Chinese economic slowdown dented investor sentiment.