When San Franciso-based Wells Fargo & Company (NYSE:WFC), releases quarterly results Friday morning, analysts will be examining the corporate filing for hints as to the state of the U.S. housing market.

A Spanish activist group fighting against bank-ordered evictions has stepped up its protest activity and embraced law-breaking -- and sometimes violent -- methods to stop the physical removal of families from their homes.

A Massachusetts man made good on a promise to make his last mortgage payment on his home with pennies.

The pace of bankruptcy filings in the U.S. is slowing down to pre-recession levels, but don?t cheer just yet ?because hundreds of thousands of Americans might have been too broke to file for bankruptcy.

During the second quarter, average rents increased to record levels in 74 of the 82 U.S. markets tracked by real estate data firm Reis Inc. (NYSE: REIS), according to a report released Thursday. A number of factors are driving the trend.

U.S. 30-year fixed-rate mortgages fell to a record low of 3.62 percent, its 10th such weekly record low in the last 11 weeks, following weak economic data, mortgage financier Freddie Mac said Thursday.

U.S. mortgage interest rates for 30-year, fixed loans are at/near 40-year lows. Further, while there's nothing like owning a home, for several reasons 'this is not your father's housing market.' There are pitfalls and pratfalls, and prospective buyers would be wise to review these five tips before taking the plunge.

The Indian division of the U.S.-based Citibank Tuesday reported a 35 percent rise in its net profit in 2011-2012 fiscal year, driven by robust growth in their corporate and retail banking and mortgage businesses, the bank said in a statement.

California, the state with the second most foreclosures by volume, has passed one of the strongest laws in the country seeking to protect homeowners from improperly losing their homes.

The top after-market NYSE gainers Friday were: SAIC, EXCO Resources, Talisman Energy, Furmanite Corp and Owens-Illinois. The top after-market NYSE losers were: Sanchez Energy Corp, Anworth Mortgage Asset Corp, Schawk, Tahoe Resources and Ultra Petroleum Corp.

For the first time in over a decade, Iceland's longtime incumbent of 15 years President Olafur Ragnar Grimsson has a viable candidate facing him for reelection this Saturday - a former television reporter who recently gave birth to a baby girl.

The Institutional Revolutionary Party is poised to retake power on Sunday after a decade out of power, led by the charismatic presidential candidate Enrique Peña Nieto. Would a change mean a much different relationship with Mexico's big neighbor to the north?

The Federal Housing Administration (FHA) won't adopt a new restriction that could have prevented thousands of prospective home buyers from obtaining low-cost mortgages.

A wave of retiring U.S. baby boomers may lead to an increase in unconventional loans known as reverse mortgages in coming years, but the practice comes with risks, according to a report released Thursday by the Consumer Financial Protection Bureau.

The European Central Bank may soon ease its lending standards in what appears to be an effort to prevent Spain's sovereign debt crisis from worsening, according to reports published Thursday. But the move could also impair the credibility of ECB.

A driver involved in a Southern California freeway brawl that was captured on video and went viral on the internet, said he regrets getting out of his and should have called the police. Jerry Patterson, a mortgage consultant and father of three said he suffered a concussion from the incident when three brutes had attacked him on the freeway, repeatedly punching and kicking him in the head.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.66 percent following weak economic indicators, mortgage financier Freddie Mac said Thursday.

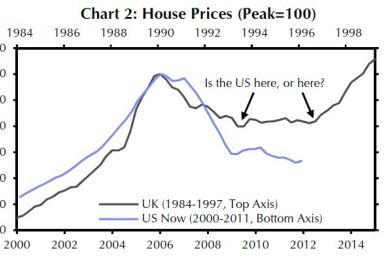

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

The powerful rate-setting committee of the Federal Reserve decided to extend its current strategy of manipulating the credit markets to artificially depress the cost of long-term financing, a strategy colloquially known as Operation Twist, until the end of the year.

China's attempt to manage inflation in the real estate market is putting pressure on local governments and pushing homebuyers overseas.

Chairman Bernanke will announce his policy decision Wednesday at 12:30 EST, and considering the recent escalation in the European debt crisis

The dissolution of Fannie Mae and Freddie Mac, the two largest U.S. mortgage guarantors, would have only a minimal impact on home ownership level, according to a new report that downplays the link between low interest rates and increased ownership.