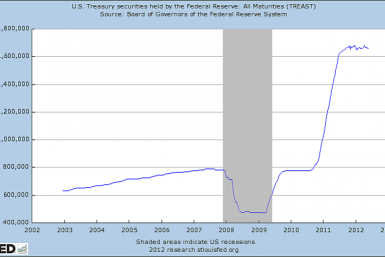

The Federal Reserve is proposing that U.S. banks, large and small, abide by a rigorous interpretation of an international capital standards agreement known as Basel III.

An increase in the spurt of mortgage applications, following low mortgages rates and a rising demand for refinancing activities

The performance of the non-manufacturing sector against the backdrop of the release of the non-manufacturing (NMI) index.

You have been warned.

Fannie Mae, the federally controlled mortgage giant, said Tuesday it is appouinting its general counsel, Timothy Mayopoulos, as its new president and CEO.

Reality TV might make media critics scoff and television writers hang their heads in dismay, but it sure pays the bills. See how much the ladies of Bravo's Real Housewives series earn.

Warburg Pincus LLC, a private equity firm based in US, is looking for a $100-$125 million stake in finance firm Future Capital Holdings, sources said to Reuters.

Mitt Romney would not offer relief for the 11.5 million U.S. homeowners with underwater mortgages if he were elected president, one of his advisers said Saturday. The assertion contrasts with Romney's own words in January: The idea that somehow this is going to cure itself by itself is probably not real.

U.S. mortgage rates dropped even lower in the week ending May 31, with the 30-year rate falling to 3.75 percent, mortgage financier Freddie Mac said Thursday.

Futures on major U.S. indices point to a lower opening Wednesday ahead of anticipated reports on the Mortgage Applications Index and Pending Home Sales.

Economic data and news flows are light this morning as market participants take stock of the significant moves across asset classes in the past wee

The CEO of a New York commercial mortgage company sold his personal condo at 15 Central Park West, one of the most expensive buildings in the world, for $23.3 million, according to city records filed Friday.

U.S. 30-year fixed mortgage rates dropped to 3.78 percent in the week ending May 24, down slightly from 3.79 percent in the previous week, mortgage financier Freddie Mac said Thursday.

Spain may say on Wednesday how it will plug a hole of at least 8 billion euros ($10.21 billion) at Bankia, part of an effort to clean up a banking sector laden with bad debts and stop the country sinking further into the euro zone debt crisis.

While global leaders obsess over the likelihood of debt-stricken Greece departing the euro zone, an emerald isle 1,800 miles away from Athens may be on the brink of needing another financial bailout.

Home prices in China fell in April, indicating that the government's efforts to curb the property market boom are gaining further momentum.

U.S. 30-year fixed-rate mortgages hit a new record low for the third straight week as concerns over the euro zone weighed on the economy, mortgage financier Freddie Mac said Thursday.

He's also lowered the asking price for his home.

U.S. builders began work on more homes than expected in April, government figures showed on Wednesday. But the data suggested that builders might also be slowing their future construction plans.

The annual shareholder's meeting Tuesday of JPMorgan Chase & Co. (NYSE: JPM), widely expected to feature fiery denunciations of leaders at the nation's biggest bank, could hardly have been quieter or more management-friendly.

During a Tuesday morning appearance on the talk show The View, President Obama attributed JPMorgan's $2 billion trading loss to a lack of financial regulation.

Homebuilder confidence in the U.S. single-family home market rose to a five-year high in May as buyer traffic increased and sales improved, according to the National Association of Home Builders/Wells Fargo Housing Market Index released Tuesday.