U.S. mortgage rates rose with the improving economy, but remained near historic lows in the week ending March 15, Freddie Mac reported Thursday.

The inspector general for the U.S. Department of Housing and Urban Development said banks involved in the nationwide settlement on foreclosure practices significantly hindered its investigation.

Finally, a mall the founder of the Mormon faith, Joseph Smith, could warm up to ... though it may not be the best shopping spot for your run-of-the-mill teenager.

The companies whose shares are moving in pre-market trade on Wednesday are: Francesca's Holdings Corp, Zions Bancorporation, Regions Financial Co, RADVision Ltd, Clearwire Corp, LSI Corp, SunTrust Banks, Citigroup, American Capital Mortgage Investment Corp and Fifth Third Bancorp.

A full-text of the Federal Open Market Committee's statement from March 13 meeting.

Economists agree the current labor recovery is creating some jobs, but disagree as to which groups will benefit the most -- and what American society will end up looking like -- as a result. Their disagreements are full of useful insight that could be the base for future policies, if only policymakers were listening.

The $25 billion settlement between five large U.S. banks accused of abusive mortgage practices on the one side and federal and state government officials on the other side that was announced Feb. 9 will be filed in federal court on Monday, people familiar with the matter said.

Freddie Mac requested $146 million from the U.S. Treasury to meet interest payment obligations on bailout funds, despite swinging to a profit, the troubled mortgage buyer reported Friday.

My dear Aunt Louise’s husband of 52 years was dying.

Bank of America, N.A., fraudulently sought to limit home-owner mortgage modifications under the Home Affordable Modification Program so as to avoid millions in losses, says a whistleblower complaint unsealed in federal court Wednesday.

U.S. 15-year fixed-rate mortgage declined to a new record low of 3.13 percent in the week ending March 8, according to Freddie Mac.

The top aftermarket NYSE gainers Tuesday were: Apollo Residential Mortgage, Sterlite Industries, First American Corp, Universal American Corp, Hersha Hospitality Trust, Bank of Ireland, iSoftStone Holdings, Seaspan Corp and Tredegar Corp.

The top after-market NASDAQ gainers Monday were: Shuffle Master, Freightcar America, Carrizo Oil & Gas, Clearwire Corp, American Capital Mortgage Investment, Rosetta Resources, Canadian Solar, CIENA Corp and Zogenix.

As of Sunday, seven companies have pulled their advertisements from Limbaugh's radio show after the conservative commentator called a Georgetown law student a prostitute and insisted she post online sex videos if she wanted free contraceptive coverage.

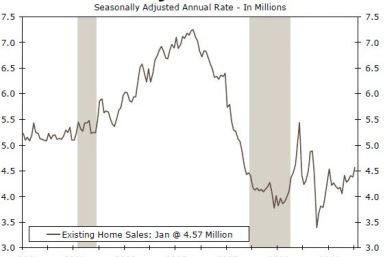

There were signs of improvement in U.S. housing data released in February, but warmer weather could have been as much of a factor as strengthening market fundamentals, according to industry experts.

U.S. 30-year fixed rate mortgage rates fell to 3.90 percent in the week ending March 1, down from 3.95 percent in the prior week, according to Freddie Mac.

Bank of America Corp. is planning to introduce a monthly fee for its customers holding checking accounts unless they agree to bank online, buy more products or maintain certain balances, the Wall Street Journal said.

Like scorned lovers, Bank of America (NYSE:BAC) and Fannie Mae, the government-controlled mortgage giant, are having a very public falling out.

U.S. Federal Reserve Chairman Ben Bernanke played killjoy Wednesday morning, delivering a somewhat pessimistic assessment of the nation's economic condition in a semi-annual address to the House of Representatives.

Goldman Sachs Group Inc., Wells Fargo & Co. and JPMorgan Chase & Co. have been warned by the Securities and Exchange Commission that they might face inquiries tied to mortgage-backed securities offered to investors several years ago.

The Securities and Exchange Commission notified Goldman Sachs Group Inc that it may file a civil case against the bank related to a $1.3 billion offering of subprime mortgage securities, Goldman said in a regulatory filing on Tuesday.

Wells Fargo & Co. and Goldman Sachs Group Inc. said Tuesday that they were facing inquiries from the Securities and Exchange Commission over civil claims connected to sales of mortgage-backed securities.