Microsoft (Nasdaq: MSFT), the world's biggest software company, reported results Thursday that beat analyst estimates for both earnings and revenue.

Stocks closed firmly lower Thursday following a choppy start, as rumors of a possible French sovereign debt downgrade and a batch of mixed U.S. data overshadowed improving corporate earnings.

Splunk (Nasdaq: SPLK), which developed software to permit enterprise analysis of so-called “Big Data,” saw its shares skyrocket nearly 90 percent in its initial public offering.

Morgan Stanley (NYSE: MS) on Thursday reported weaker first-quarter profit but still beat analyst expectations, which helped lift shares up more than 2 percent.

Bank of America Corp. (NYSE: BAC), the second largest U.S. bank by assets, said its first-quarter earnings fell 68 percent due to a $4.8 billion accounting charge related to debt valuation.

Facebook’s $1 billion deal to acquire Instagram may have resulted in pushing the initial public offering price for the No. 1 social media network even higher.

Exxon Mobil (NYSE:XOM), the largest U.S. oil company, and one of the major players in reviving the Iraqi oil industry, has been excluded from that country's next energy auction amid a dispute between Baghdad and the Kurds.

Dow Chemical Co. (NYSE: DOW), the second-largest chemical company by revenue, said Thursday it will build an ethylene plant in Texas to take advantage of the sharply lower costs of natural gas feedstock, something its foreign rivals cannot take advantage of.

McDonald's Corp. (NYSE: MCD), the world's largest restaurant chain, is expected to report higher first-quarter revenue and earnings per share on Friday as a mild U.S. winter boosted foot traffic and thinning wallets drove consumers to cheaper food options.

Eurosclerosis may finally have hit the technology sector.

Global markets saw a shallow but broad selloff Wednesday, as unsettling news from Spain combined with a histrionic report by the International Monetary Fund to give investors pause regarding the situation in Europe.

Cameron International Corp. (NYSE: CAM), a provider of flow equipment products, systems and services to the energy industry, has reached a deal to acquire Bergen, Norway-based TTS Group ASA's (OSE:TTS) drilling equipment business for $270 million plus additional payments for three years based on their revenues.

European banks could be forced to shrink their balance sheets by as much as $3.8 trillion through 2013, or almost 7 percent of total assets, with a quarter of the deleveraging likely to come from cuts in lending and the remainder from sales of securities and noncore assets, the International Monetary Fund said Wednesday.

The conservative American Legislative Exchange Council disbanded a task force that had advocated for “Stand Your Ground” laws in states as well as voter identification laws.

Stocks were lower on Wednesday after uninspiring earnings from IBM and Intel, while Chesapeake Energy slumped after a Reuters report highlighted large and unusual personal loans taken by its chief executive.

Advanced Micro Devices (NYSE: AMD), the No. 2 microprocessor developer, has nowhere to go but up. Investors this year have sent its shares soaring nearly 50 percent.

The CEO of Chesapeake Energy Corp. (NYSE: CHK), the nation's second-largest natural gas producer, has received over $1.1 billion in unreported loans over three years, Reuters reported on Wednesday.

Honeywell International Inc. signed a $2.8 billion deal to provide airplane Wi-Fi hardware for Inmarsat PLC's Global Xpress network, Honeywell announced Wednesday.

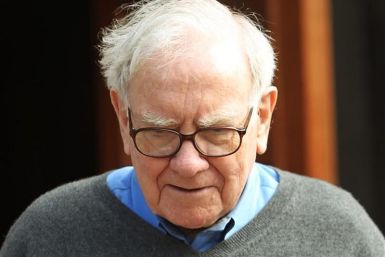

Shares of Berkshire Hathaway (NYSE: BRK/A) shrugged off news that CEO Warren E. Buffett has prostate cancer and will require treatment soon.

Bank of America (NYSE: BAC) is expected to report highly disappointing financial results Thursday morning, a development that -- as has been the case in the past -- will provide plenty of schadenfreude to the company's vociferous and numerous critics.

Shares of Abbott Laboratories (NYSE: ABT) rose Wednesday after the health care products maker reported a 43 percent jump in first-quarter earnings on a higher sales in emerging markets and also raised its full-year earnings guidance.

Microsoft (Nasdaq: MSFT), the world's biggest software company, is expected to report slightly lower third-quarter results Thursday, despite the slight uptick in PC sales.