South Korea announced on Sunday it will start charging a levy on banks' foreign exchange borrowings, a measure aimed at limiting the chances of capital exiting the economy at a time when military tensions with the North are escalating.

President Obama's tax cut plan, by lowering unemployment and boosting economic growth, may ease the Federal Reserve's pressure to buy Treasuries via its controversial program of quantitative easing.

Economists at Morgan Stanley think Latin American currencies will continue to appreciate in 2011 because of economic growth, interest rate differentials versus the U.S. dollar, and the expected positive performance of commodities.

Precious metals were down in Asian trade on Wednesday, as dollar's gains following Tuesday's FOMC decision to keep the US quantitative easing program uninterrupted weighed on the investment appeal of the commodities.

U.S. retail sales continued to rise in November for the fifth month, boosted by holiday shopping as well as fuel prices, the U.S. Commerce Department said.

An escalation of trade tensions between China and the U.S. may involve protectionist measures on the U.S. side and the creation of exclusionary Asian trade walls on China's side.

A survey conducted by Association for Financial Professionals showed the executives do not believe that additional fiscal stimulus is necessary or desirable at this stage.

The EUR/USD distanced itself from a falling channel ahead of the Fed policy and rose to a three-week high on Tuesday. The single currency, however, pared some of its gains after data at 10:00 am GMT showed the region's industrial output rose at a lower-than-expected pace in October.

China is stepping up its efforts to contain inflation, even as the latest economic report indicates that inflation hovers around a 28-year high of 5.1 percent in November.

Economists are more positive about economic growth in 2011 in the United States, according to a survey by the Wall Street Journal.

There are plenty of concerns surrounding U.S. Treasuries, yet a Treasury crisis doesn't seem to be happening.

The potential expiration of the Build America Bond (BAB) program at the end of this year may have a negative near-term impact on the prices of the overall municipal bond market.

The U.S. economy will begin to show signs of improvement in 2011 as major indicators such as housing and consumer spending begin to improve by mid-2011, according to an annual outlook report from Wells Fargo.

Two Morgan Stanley economists predict that U.S. 10-year Treasury yields will rise to about 3.75 percent by the end of 2011 because of accelerated economic growth.

The United States is expected to see weak employment prospects though employers expect the modest hiring pace to continue in the first three months of the year, a survey reported.

A study by IMF economists Luc Laeven and Hui Tong found that U.S. monetary policy shocks drive global stock market prices.

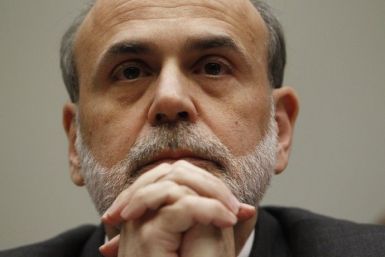

Stocks, which fell early in the session on some gloomy remarks on the economy from Federal reserve Chairman Ben Bernanke, pared much of their losses later in the day on hopes that The Republicans and Democrats in Congress can hammer out a compromise on extending the Bush tax cuts as well as unemployment benefits.

Investors who are worried about the health of the stock market might take some solace from the evidence that the U.S. equities have performed exceptionally well during the third year of a presidential term (Barack Obama enters the third year of his administration in January 2011).

Despite a dovish Bernanke, EUR/USD's attempt to break above the upper limit of a downward channel from early November highs on the back of a weak non-farm payrolls data proved unsuccessful as debt-related worries of euro-zone continued to weigh on the single currency.

During a CBS interview, Federal Reserve Chairman Ben Bernanke did not rule out the possibility of more asset purchases, meaning a third round of quantitative easing (QE3) is possible.

Gold rose almost 2 percent on Friday, ending the week on $1,414 an ounce just a few dollars below the all-time record, as the dollar tumbled after disappointing jobs data cast doubt on the strength of the U.S. economic recovery.

A late-session rally pushed stocks modestly into the black after a very disappointing November jobs report battered equities earlier in the day.