Experts warn that the worsening of the debt crisis means dramatic hike in interest rates, a free fall of the dollar and higher inflation. The negative impact of this scenario will be felt across the world, bedeviling economic recovery everywhere. Critics say the Federal Reserve mandarins are engaging in the outright destruction of the dollar.

The solid demand for gold is not supported just by private individuals and panicky investors, but countries like China, India and Russia are ramping up investment in the yellow metal.

Gold Prices broke back above $1500 on Friday morning, only to fall back to $1488 per ounce in early New York trading.

Can the financial markets recover from their recent decline in the face of the end of QE2? We believe that the answer is clearly “yes.”

Spot Gold prices rallied against all major currencies on Wednesday morning, hitting $1491 per ounce and rising 1.2% from yesterday's eight-day low as stock and commodity markets also gained.

Prices to Buy Gold rose but silver held flat in Asian and London trade on Wednesday, while the Dollar fell, European equities rose, but peripheral Eurozone debt sank to new record lows.

Venezuela’s inflation is at 29 percent and Argentina’s actual inflation (many allege the government data is fraudulent) is north of 20 percent.

Spot Gold slumped 1.4% lunchtime Friday in London, falling back from its highest-ever monthly close as the Dollar jumped on news of stronger-than-expected US jobs hiring in March.

The Bank of Japan (BOJ) should be much more aggressive, said Paul Sheard, global chief economist of Nomura Securities.

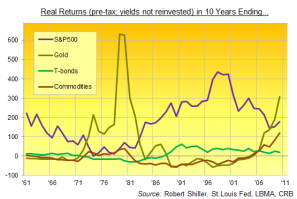

What's your true level of risk today? No idea. But the least your fund manager, advisor or favorite financial columnist can do today is remember the lesson of 2007, and highlight the range of risks and possible fall-out which might lie ahead. Take inflation, for instance. Though small, the risk of currency devaluation and hyper-inflation in the developed West is still materially underpriced by gold bullion

The price of gold may touch $5,000 an ounce in the next 4 to 5 years, California-based Capital Gold Group Inc. says.

Gold rose above $1,430 an ounce on Friday, while silver surged 3 percent to 31-year highs, as soaring oil prices fueled by widening clashes in Libya prompted investors to pile into safe havens.

Against gold, the US dollar has been falling rapidly in recent years, which betrays some investors' lack of confidence in the currency.

Gold rose toward $1,425 an ounce on Friday as U.S. February payrolls data supported expectations the Federal Reserve will hold off tightening monetary policy and as unrest in North Africa continued.

The loose monetary policy in the United States is little better than a narcotic and will harm the rest of the world more than it helps Americans, a former Chinese vice commerce minister told Reuters.

Bill Gross of PIMCO is concerned for the US government. To him, the big question is who will buy US Treasuries (i.e. lend to the US government) once the Federal Reserve stops QE2.

“When inflation gets started, you don't particularly notice it,” said billionaire investor Warren Buffett on CNBC. “It's like a guy jumping out of a 50-story building. The first 45 stories he doesn't really notice a lot of changes in his circumstances. But eventually, [he hits] the ground.

Federal Reserve Chairman Ben Bernanke said both rounds of quantitative easing (QE1 and QE2) are working well, in the question and answer session of his testimony to Congress.

Federal Reserve Chairman Ben Bernanke remains unconcerned about inflation - perhaps rightly so - at a testimony in front of US lawmakers on Tuesday.

“We have seen increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” said Federal Reserve Chairman Ben Bernanke in a testimony to Congress.

The inflation debate is raging in the UK among policy makers. Meanwhile, the only inflation hawk and dissenting voter on the Federal Open Market Committee (FOMC), Thomas Hoenig, is no longer a voting member this year.

Criticism of China's exchange-rate policy continues throughout the US. This column argues that the US is in fact the exchange rate manipulator, due to its ongoing quantitative easing. What the US needs to do for a sustainable turnaround is to learn from other successful economies like China and Germany - not de-rail them.