Policymakers in advanced economies should use all available tools to boost growth, International Monetary Fund Managing Director Christine Lagarde said on Friday, calling for bold action to weather a dangerous new phase of recovery.

China's central bank chief poured cold water on Thursday on talk that Beijing could make the yuan fully convertible as soon as 2015.

China's central bank chief poured cold water on Thursday on talk that Beijing could make the yuan fully convertible as soon as 2015.

Republican presidential hopeful Mitt Romney said on Wednesday that if he were elected president, he would not keep Ben Bernanke as chairman of the Federal Reserve.

Brazil vowed on Tuesday to defend its domestic industry against unfair competition and slapped import tariffs on select Chinese steel products.

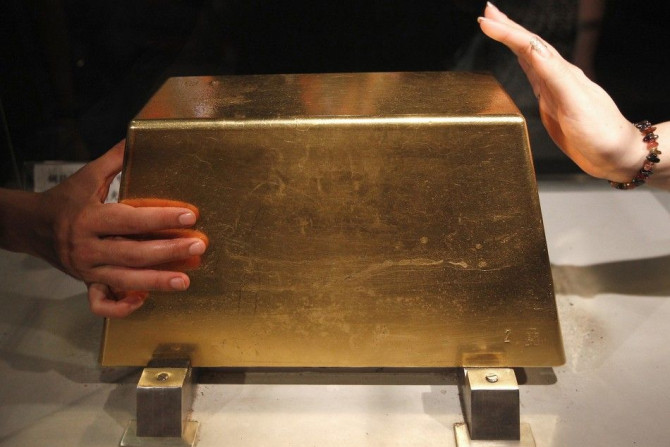

Gold rose to a 1-1/2 week high on Friday as investors sought refuge in safe haven assets after a disappointing labour market report from the United States added to mounting fears about the pace of recovery in the world's largest economy

The U.S. economy created no net new jobs in August -- a disappointing report that will likely increase pressure on the U.S. Federal Reserve to deploy additional monetary tactics to help rev-up GDP growth to create the millions of jobs the nation needs. Also, the unemployment rate remained the same, at an eye-sore level of 9.1 percent.

Gold rose to a 1-1/2 week high on Friday, benefiting from caution about the euro zone debt crisis and ahead of the key U.S. non-farm payrolls data which is likely to underscore the frail state of the world's largest economy.

European shares fell sharply on Friday, snapping a four-session rally, as traders feared U.S. non-farm payrolls numbers could signal a return to recession.

The pace of U.S. private sector job growth slowed in August for the second month in a row, but factory activity in the Chicago area continued to expand, suggesting the economy would dodge a recession.

Gold fell on Wednesday after a near 3 percent rally the day before sparked by Federal Reserve comments on possible measures to boost U.S. growth, and the bullion price is still set for its biggest monthly gain in nearly two years.

Brent crude hovered at $114 a barrel Wednesday, after posting six days of gains, on expectations the United States will act again to try and boost growth and increase demand for oil.

The biggest impact from QE3 could come from Ben Bernanke announcing it rather than it actually going into effect.

China's central bankers have found a new way of keeping banks from lending too much, a step Beijing hopes will help it tackle the country's persistent inflation woes.

In his Jackson Hole, Wyo. conference speech, U.S. Federal Reserve Chairman Ben Bernanke said, in so many words, that headwinds -- some organic, some Capitol Hill-ish -- confronting the U.S. economy are strong, but the Fed is stronger.

The U.S. economy grew at a worse-than-expected 1.0 percent rate in the second quarter, the U.S. Commerce Department announced Friday, in its second estimate for the quarter, as lower export growth and a slowdown in inventory build-up braked the world's largest economy to near-stall speed.

Gold prices arrested this week's slide on Friday to rise nearly 1 percent ahead of a speech from Federal Reserve chairman Ben Bernanke in Jackson Hole, Wyoming, later, which will be closely watched for hints on the outlook for Fed monetary policy.

Stock futures pointed to a slightly higher open for equities Friday after declines in the previous session, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 all up 0.2 percent.

Fed Chairman Ben Bernanke's much-anticipated speech Friday will likely disappoint investors and policy makers hoping for signs the central bank will try to rev up the weak economy, but the speech is likely to relieve gold investors who have booked big profits from that same economic malaise.

Gold rose on Thursday after two days of sharp declines, as tumbling European and U.S. equity markets sparked by talk that Germany might enact a short-sale ban prompted investors to buy gold as a safe haven.

The euro inched up against the dollar on Thursday, tracking gains in European shares on speculation the Federal Reserve may signal more economic stimulus measures, but analysts saw the risk of a correction if such expectations are not met.

SPDR Gold Trust said its holdings fell 2.2 pct, in its biggest one-day drop in seven months, as gold futures slid more than $100 on strong U.S. economic data and ahead of a key Federal Reserve meeting.