Gold prices retreated in choppy trade on Tuesday after earlier hitting record highs as a recovery in appetite for assets seen as higher risk, such as stocks, took the steam out of a rally that many saw as overdone above $1,900 an ounce.

Gold prices retreated more than 1 percent from record highs on Tuesday as a recovery in appetite for assets seen as higher risk, such as stocks, took the steam out of a rally that many saw as overdone above $1,900 an ounce.

Gold prices retreated more than 1 percent from record highs on Tuesday as a recovery in appetite for assets seen as higher risk, such as stocks, took the steam out of a rally that many saw as overdone above $1,900 an ounce.

The price of gold ripped past $1,900 per ounce Monday, boosted by fears of enough wealth-destroying developments to erase any doubts that the world's oldest safe-haven investment is still the world's No. 1 safe-haven investment.

Gold set a new record Monday as investors fled stocks, weakening currencies and U.S. Treasuries for the safety of gold and gold-related assets.

Gold rallied almost 2 percent to a record near $1,900 an ounce on Monday as a sputtering global economy boosted expectations for further monetary easing, raising bullion's appeal as a hedge against inflation.

Stock markets surged Monday as investors awaited a Federal Reserve meeting, which will take place later this week, when a new stimulus plan may be announced. The gains were also enabled by gains in European markets.

Moves by the Swiss National Bank to curb strength of the Swiss franc will fuel investors' insatiable demand for gold, adding to its relentless rise to new record highs as confidence in the franc as a safe store of value dwindles.

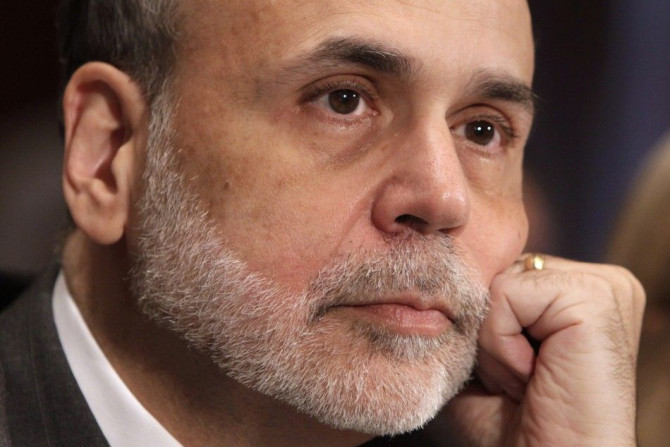

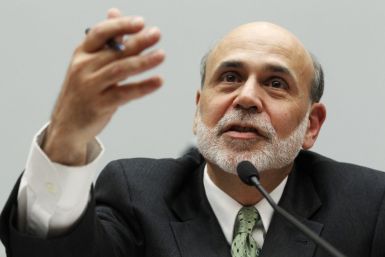

With the U.S. recovery having slowed considerably, and Europe debt woes persisting, investors will look to Fed Chairman Ben Bernanke's Jackson Hole, Wyo. speech later this week to provide clues regarding the central bank's evaluation of the economy, and at what point it thinks additional stimulus would be needed.

The price of gold early Monday came within $2 of a record high $1,900 per ounce before settling back to 1.2 percent gain over Friday's closing price as a host of global economic worries drove investors into the security of the world's oldest form of money.

Gold prices rallied toward $1,900 an ounce on Monday as concerns over the global economic outlook fueled interest in the precious metal as a haven from risk and due to talk that weak U.S. growth could spark a further round of monetary easing.

Brent crude dropped more than $3 on Monday to below $106 a barrel, while U.S. oil fell more than a dollar to below $82, on the potential for a resumption of exports from OPEC-member Libya as a six-month civil war there appeared close to an end.

Gold rose 1.5 percent on Friday, setting a record high for a second straight day and heading for its biggest one-week gain in 2-1/2 years on worries about stalled U.S. growth and Europe's debt crisis.

We must not lose sight that Treasury yields have been artificially lowered by the massive buying program of the Federal Reserve associated with QE2.

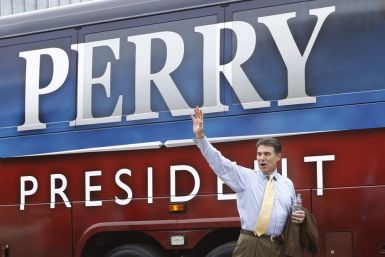

The White House denounced Republican presidential candidate Rick Perry on Tuesday for his threatening remarks toward the head of the U.S. Federal Reserve that represented some of the most inflammatory rhetoric of the 2012 election campaign.

Rick Perry?s comments on the reckless printing of paper are calling into question the constitutionality of certain economic policies and actions of the Obama administration.

Debt concerns in Europe and a tepid U.S. economy have made for a bumpy stock market of late, to day the least. However, because one-day events can deceive, let's pull the lens back and do a condensed, cross-methodological analysis of the Dow Jones Industrial Average, to see if it reveals any long-term clues.

This week investors should focus on the performance of European sovereign debt markets.

Although they?ve largely avoided enormous layoffs, there?s no reason for Middle Eastern banks to rest on their laurels, says The Islamic Globe.

Oil is likely to remain weak in the short term due to the sluggish global economy, while gold reaches new peaks on its increasing safe haven appeal and an expected further easing of U.S. monetary policy, a London-based fund manager said.

In days past, jawboning from Presidents and central banks was often enough to stem a financial markets selloff. Not anymore.

Which is a better way to battle the capital market blues: the Swiss franc or Frank Sinatra?