The S&P 500 rose above 1,400 for the first time since May 3 behind further calls for another central bank stimulus and hopes that the European Central Bank will take action.

Standard & Poor's Ratings Services said Monday afternoon that it lowered its corporate credit rating and other ratings on Best Buy Co., Inc. (NYSE: BBY) from "BBB-" to "BB+," or junk status.

Baidu.com, Goodyear Tire & Rubber, NXP Semiconductors, Telecom Italia, Elan Corp, Infosys Ltd, Banco Santander and Barclays Plc. are among the companies whose shares are moving in pre-market trading Tuesday.

The European summit may have increased investor confidence, but weak consumer spending across Europe, along with the rise of the dollar against the euro, is slowing down the global economy, pushing many companies to trim their earnings forecasts.

Standard & Poor's Ratings Services has raised the credit rating of the Philippines, citing that the country's fiscal flexibility is gradually increasing and the debt profile is improving.

Single-family home prices picked up for the third month consecutive month in April, showing signs that the housing market recovery is gaining traction.

Expectations for U.S. company earnings are on a slippery slope down Wall Street. While the downward slide in estimates highlights the caution analysts and companies are expressing, investors should also be aware that companies are setting lower goals so that they can look better or be able to ?beat estimates? when the results come out.

Up to 5.1 million Jeep Grand Cherokee, Jeep Cherokee and Jeep Liberty model SUVs may be subject to one of the largest recalls in history depending on the results of an engineering analysis by the National Highway Traffic Safety Administration (NHTSA).

The Delhi High Court Wednesday issued notices to the Indian government and Air India management on the striking pilots' plea for their salaries for March.

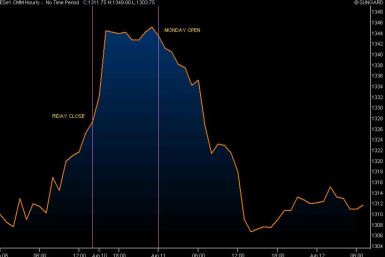

Friday closed on rumours of A Spanish Bailout, which were confirmed over the weekend, prompting a risk rally when Asian markets opened on Sunday evening.

Credit rating agency Standard and Poor's (S&P) Monday said that India could lose its investment grade rating due to its weak GDP growth rate and political roadblocks to economic policymaking.

Standard & Poor's said on Monday that India could become the first of the so-called BRIC economies to lose its investment-grade status, sending the rupee and stocks lower, less than two months after cutting its rating outlook for the country.

China's easy money and Spain's hard choice to accept a bailout of its cash-strapped financials sector appear to have market participants feeling pretty chipper in the early going on Monday.

Fiat S.p.A. plans to close its headquarters in Mirafiori, Italy for eight additional working days this summer to save ?8 million ($10.1 million) following lackluster European profits for the company.

With the Institute for Supply Management's manufacturing report and the U.S. Bureau of Labor Statistics' Employment Situation Summary both weaker than analysts' consensus estimates on Friday, U.S. stocks closed a holiday-shortened trading week by dropping like so many hot pennies scattered in cold snow.

Sales grew across the board in May for U.S. automakers with Chrysler Group LLC, a subsidiary of Italian Fiat S.p.A. (Milan: F), leading the way in growth and General Motors Company (NYSE: GM) leading in volume, while Ford's car and truck sales remained strong on demand for fuel-efficient vehicles. The Asian carmakers also reported U.S. sales on Friday with Toyota Motor Corporation (NYSE: TM) enjoying bumper growth of 73 percent.

Chrysler Group LLC, a subsidiary of Italian Fiat S.p.A. (Milan: F), reported May U.S. auto sales up 30 percent, the best showing for the month in five years and the 26th consecutive month of year-over-year sales gains for the revivified company.

Fiat Industrial S.p.A. (Milan, FI), a 2010 spin-off of Fiat S.p.A. that makes trucks and tractors, plans to merge with CNH Global NV (NYSE: CNH), the producer of Case and New Holland brand tractors, the company announced Wednesday.

U.S. auto sales will likely reach a 14.2 million seasonally adjusted annual sales rate in May 2012, the greatest year-over-year gain in more than 12 months, as consumers take advantage of credit and low interest rates to replace aging cars. Moreover, increasing car sales are now a primary driver of U.S. GDP growth, according to a Wednesday report by Kelley Blue Book.

Mazda Motor Corporation (Tokyo: 7261) and Fiat Group Automobiles S.p.A. (ETR: FIAT) will jointly develop and manufacture a new rear-wheel-drive, roadster sports car based on the next-generation Mazda MX-5 Miata for the Mazda and Alfa Romeo brands, the companies announced Wednesday.

Chrysler Group LLC is recalling 67,872 model year 2010 Jeep Wrangler cars equipped with automatic transmissions because of fire hazards associated with the transmission skid plate, the National Highway Traffic Safety Administration reported Monday.

General Motors Company (NYSE: GM) rocked the automotive and advertising worlds with its announcement Tuesday that it will stop buying advertisements on Facebook Inc. (Nasdaq: FB), a value of roughly $10 million a year, on the eve of social networking site's monster IPO. The rest of the automotive industry's major players are not following suit, though, Ford Motor Company (NYSE: F), banking on the strength of the network effect, is actually upping its investment.