Despite Monday's 92-4 vote, Republicans are likely to kill the bill later this week if, as expected, they're not allowed by the Senate's Democratic leadership to propose amendments.

India will call upon local airlines to boycott the European Union's carbon-offsetting tax, as an ongoing row over a recently-instated tax on flights in and out of Europe has sparked discontent from several nations and heightend fears of a trade war.

With massive debts to repay, Dublin was compelled to accept huge bailouts from the European Union and International Monetary Fund.

The American Mustache Institute, a lobbying group that hopes to offer tax breaks to mustached Americans, has found an unlikely ally in Congress: Maryland Republican Rep. Roscoe Bartlett. Congressman Bartlett has referred the proposed bill, the Stache Act, to the House Ways and Means Committee. The Stache Act would give individuals sporting mustaches up to $250 in tax credit every year.

A huge event is being planned at our nation's capitol. The American Mustache Institute is hammering out the details for the Million Mustache March, as part of their continuing effort to promote facial hair and convince lawmakers to promote government incentives for mustaches and beards alike.

The airline fat tax is closer to becoming a reality after a ruling in England's Court of Appeal.

Millionaires would pay a minimum 30 percent effective tax rate under a law introduced on Wednesday in the Senate with the backing of President Barack Obama and named after billionaire investor Warren Buffett.

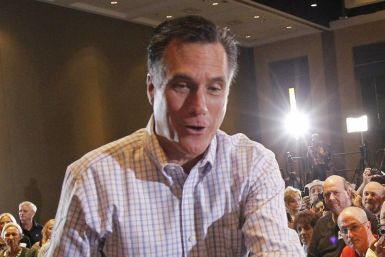

Romney has shown a propensity for making tone-deaf statements that remind voters of his immense wealth and corporate background. Here is a list of the five most cringe-worthy.

Despite having been married thrice and boasting of a history of marital infidelity, Republican presidential hopeful Newt Gingrich seems to be a firm believer in the sacrosanct institution of male-female marriage. On a conference call for Religious Right supporters, on Wednesday, Gingrich drew parallels between gay marriage and the rise of paganism.

A slight majority of Americans -- 52 percent -- say they favor raising tax rates on capital gains to match the rate for wage income, according to new poll by The New York Times and CBS.

Former Gov. Mitt Romney paid $3 million in federal taxes on 2010 income of $21.7 million in 2010. That means his effective income tax rate was 13.9 percent -- lower than what the vast majority of wealthy Americans pay.

If Mitt Romney's 15 percent estimate is accurate, his effective tax rate is below average even among the wealthiest Americans. He may face criticism from his peers among the top1 percent in income as well as the middle class when he releases his 2010 tax returns on Tuesday.

Art Laffer is named in a lawsuit from a group of investors who say he lent his name to investment funds that ran a Ponzi scheme through a talk radio business.

For all the hand-wringing about Mitt Romney being insufficiently conservative, the last few days have demonstrated how a Romney candidacy would give voters a clear alternative to the progressive vision articulated by President Barack Obama.

Nobody, not the EU, the IMF nor the markets had any concerns about the Irish fiscal position prior to 2008.

Huge U.S. corporations are forming lobbying groups to try to influence what could become the hottest congressional debate over comprehensive tax reform in a generation.

The Republican brand, built on a rock-solid no new tax pledge to voters, is showing a few cracks as internal party divisions erupt in the face of rapidly escalating U.S. government debt.

President Barack Obama vowed to boost U.S. efforts to fight AIDS with a new target of providing treatment to 6 million people worldwide by 2013, up from an earlier goal of 4 million.

China's annual inflation rate fell sharply in October to 5.5 percent in a further pullback from July's three-year peak, giving Beijing more room to fine tune policy to help an economy feeling the chill of a global slowdown.

China's annual inflation rate eased to 5.5 percent in October, a third straight month of decline from July's three-year peak and Premier Wen Jiabao said prices had fallen further since then.

State governments across the United States are just a few months into their fiscal years and already many fear that tax revenues are running short of forecasts.

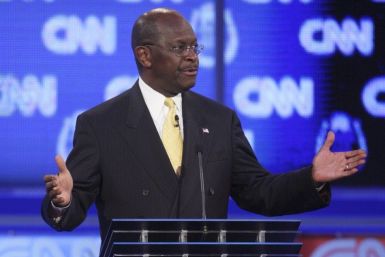

Yogi Berra is right: It's déjà vu all over again with respect to Republican flat tax proposals -- Herman Cain's 9-9-9 plan bears striking similarities to an ill-fated proposal made by Republican presidential candidate Steve Forbes in 1996.