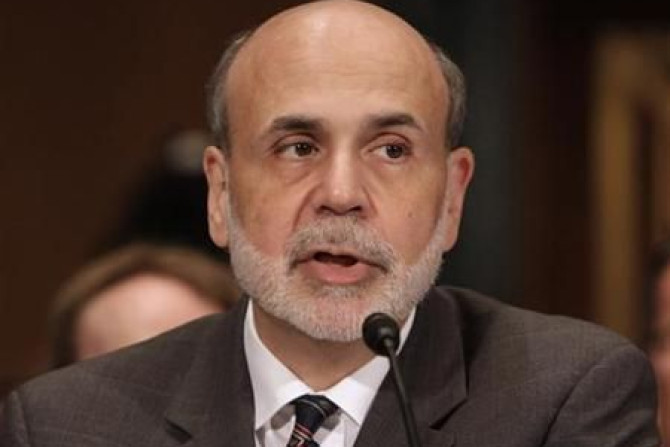

U.S. employment growth ground to a halt in August as sagging consumer confidence discouraged already skittish U.S. businesses from hiring, keeping pressure on the Federal Reserve to provide more monetary stimulus to aid the economy.

The U.S. wealth management industry is shrinking, losing legions of advisers, just as demand for their services is on the rise.

The higher gold climbs the more intense the debate between bulls and bears, those who think the yellow metal has a long way to run before it even approachs its 1980 inflation-adjusted high of $2,400 and those who say the latest nominal record of $1,852.20 is just waiting to pop.

FBR Capital Markets has upgraded the shares of VMWare, Inc. (NYSE:VMW) to "outperform" from 'market perform," saying that the company would be a leading beneficiary of increasing demand for virtualization solutions.

HSBC is selling its U.S. credit card arm to Capital One Financial Corp in a $32.7 billion deal as Europe's top bank streamlines its mammoth operations.

FBR Capital Markets upgraded its rating on shares of Wells Fargo & Co. (NYSE: WFC) to "outperform" from "market perform" while maintaining its price target of $31 as valuation was too attractive to ignore.

The Dow Jones Industrial Average was rocked by investor fear on Monday, dropping 634 points during trading.

As the Dow Jones Industrial Average dropped more than 500 points on Monday, banking giant Bank of America saw its share price get hammered.

Bank of America Corp (BAC.N) shares fell as much as 9.5 percent to their lowest level since April 2009 on Monday morning over fears of a slowing U.S. economy and challenges to a multi-billion dollar mortgage settlement.

The U.S. lost its AAA credit rating from Standard and Poor's for the first time in history, dealing a symbolic blow to the world's economic superpower. The impact of this downgrade is a matter of speculation.

The United States lost its top-notch AAA credit rating from Standard & Poor's on Friday, in a dramatic reversal of fortune for the world's largest economy.

Wells Fargo & Co may have to buy back an additional $1.8 billion in toxic mortgages from outside investors on top of claims it already received, the fourth-largest U.S. bank by assets said in a securities filing on Friday.

Shares of Research in Motion are at a yearly low. But they could recover with new Blackberry products. Or attract a bidder.

The government-subsidized prescription plan for seniors will not increase by the time 2012 rolls around, and yet, the plan will cost seniors an average of $30 a month in 2012, down from $30.76 this year, according to a statement made by the U.S. Department of Health and Human Services on Thursday.

Moody's Investors Service on Tuesday confirmed its Aaa rating of the United States, citing the decision to raise the debt limit, but assigned a negative outlook that could pressure lawmakers to cut the U.S. deficit.

Manufacturing grew at its slowest pace in two years in July as new orders contracted, casting doubt on expectations the faltering recovery would quickly regain steam.

Merrill Lynch, the second largest U.S. brokerage by assets and financial advisers, on Monday said it hired seven new advisers overseeing more than $800 million in combined client assets.

HSBC Holdings Plc (HSBA.L) should unveil a half-year profit of near $11 billion on Monday, flat from a year earlier as weak investment bank trading and wobbly U.S. and European economies offset growth in Asia.

U.S. gross domestic product (GDP) rose just 1.3 percent in the second quarter and a scant, revised 0.4 percent in the first quarter -- statistics that reveal a U.S. economy that's not only growing at a very slow rate, it's in danger of falling back into a recession.

Some major bond fund managers are asking their institutional clients to consider waiving strict requirements that might force mass selling of Treasury bonds if the United States loses its AAA rating.

Apple's star device iPad is the undisputed leader in the consumer segment of the tablet market and is now on the roll to capture the enterprise tablet segment as well.

Wells Fargo will pay an $85 million fine for mortgage abuses, but the company is not admitting wrong doing.