Connecticut's attorney general is investigating a possible data breach in which Wells Fargo & Co may have disclosed customer Social Security numbers as part of a fraud investigation.

Richard Cordray's short time as Ohio's attorney general earned him national recognition as a Wall Street watchdog.

Wells Fargo Securities believes 2012 will be very similar to 2011 in that there are plenty of risks affecting prospects for economic growth across the world.

Colorado could face a persistent structural budget imbalance for many years to come despite a recovering economy, according to Wells Fargo economists.

John Robin Whittle, a Tampa Bay area man, ordered a beer, left for 30 minutes to rob a Wells Fargo Bank around the corner, and then returned to the bar to finish his beer. Police arrested him 10 minutes later.

California Attorney General Kamala Harris sued Fannie Mae and Freddie Mac on Tuesday in an effort to expand her probe into the companies' mortgage foreclosure practices.

The Arizona state economy is expected to grow but at a lower gear than that which the state was accustomed to during the housing-market-driven-growth days, as the economy is still recovering from the recession and the collapse of the housing market.

The outlook for Europe looks gloomy especially after the European Central Bank (ECB) warning that risks to euro area financial stability increased considerably in the second half of 2011, as the sovereign risk crisis and its interplay with the banking sector worsened in an environment of weakening macroeconomic growth prospects.

An economist at Wells Fargo Securities expects homebuilding to improve modestly in 2012, with most of the gains coming from apartment construction.

Housing starts rose much more than expected during November, as unseasonably warm weather allowed builders to begin work on more projects than they usually do in November.

U.S. stocks soared on Tuesday. The Dow Jones Industrial Average (DJIA) ended up 337 points, or 2.9 percent, to close at 12,103. The S&P 500 Index rose 36 points, or 3 percent, to 1,241, while the NASDAQ rose 80 points, or 3.2 percent, to 2,604.

Bank of America CEO Brian Moynihan ate his words as the Charlotte, N.C.-based bank once again resorted to non-investor-friendly measures to raise capital, despite saying the bank would not take such actions.

Homebuilder confidence was up in December for the third consecutive month, according to the National Association of Home Builders (NAHB) and Wells Fargo.

Wells Fargo & Co. (WFC) announced Monday the firm is expanding its international commercial finance capabilities through acquiring Burdale Financial Holdings Ltd and the portfolio of Burdale Capital Finance Inc. from Bank of Ireland Plc (BKIR). The portfolio represents approximately $1 billion in loans outstanding from U.S. and U.K. customers. Bank of Ireland, the nation’s largest bank, will receive about 690 million euros ($899 million) from the sale.

A tax break for 160 million American workers was in doubt Monday in the face of strong opposition from Republicans in the House of Representatives who have rejected a two-month extension overwhelmingly approved by the Senate over the weekend.

Recently, non-farm employment in New Jersey has been shaky, with employment falling in two of the last three months. Much of the job loss has been in the leisure and hospitality and information sectors, said an economist at Wells Fargo Securities.

The fate of an expiring tax break for 160 million American workers was in doubt on Sunday after the top Republican lawmaker declared his opposition to a two-month extension passed overwhelmingly by the Senate.

The federal government's Home Affordable Modification Program is far from perfect, said Josh Zinner, an advocate with the Neighborhood Economic Development Advocacy Project in New York, "but the biggest problem is servicers not doing their job."

With less than two weeks left before the end of the year, all kinds of market participants, from economists at multinational banks to stock bloggers in their bedrooms, have begun to give their predictions for 2012. Here is a lucky set of seven predictions that could benefit investors next year.

Deutsche Bank AG has launched the sale of a large chunk of its global asset management business, with a price tag seen between 2 billion euros ($2.6 billion) and 3 billion, two financial sources familiar with the sale process said on Friday.

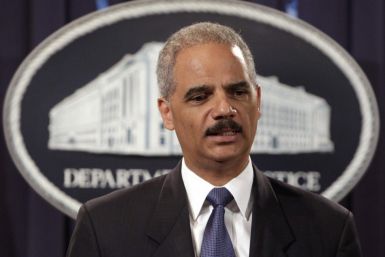

Sen. Maria Cantwell wrote to Attorney General Eric Holder Thursday expressing concern that a nationwide settlement regarding major banks' foreclosure practices should not grant immunity in future investigations into their conduct leading up to the mortgage crisis.

Wells Fargo & Co. (NYSE:WFC) was fined $2 million Thursday by the Financial Industry Regulatory Authority, a regulatory group that oversees investment advisers and other finance professionals, for neglecting to discipline an investment manager who became the firm’s top salesman of a certain kind of exotic investment instrument by forcing it on unwilling, elderly clients.