U.S. Housing Hold-ups Put Thousands Of Jobs On The Line

U.S. mortgage lenders, refinancing companies and real-estate brokers may lay off thousands of employees in the coming months, industry sources said, as many Americans put off buying a home.

Low interest rates, stimulus payments and working from home during the coronavirus pandemic had prompted many millennials to hunt for new homes, fuelling a red-hot U.S. housing market.

But the market is now cooling amid economic uncertainty resulting from the Ukraine conflict and a jump in mortgage rates as the Federal Reserve raises the cost of borrowing.

"We're seeing a reduction in buyer interest because of the cost of buying home and that's due to both the run up in interest rates as well as the ongoing high cost of actually building a home," said Robert Dietz, chief economist at the National Association of Home Builders.

U.S. existing home sales tumbled to a two-year low in May but the median house price rose 14.8% from a year earlier to an all-time high of $407,600, passing $400,000 for the first time.

Ratings agency Fitch expects new home sales this year to fall 2%, compared to its earlier forecast of a 1.8% rise.

The U.S. housing industry, which employs hundreds of thousands of people, is responding by shrinking.

This month, real estate brokers Compass Inc and Redfin Corp both announced hundreds of job cuts.

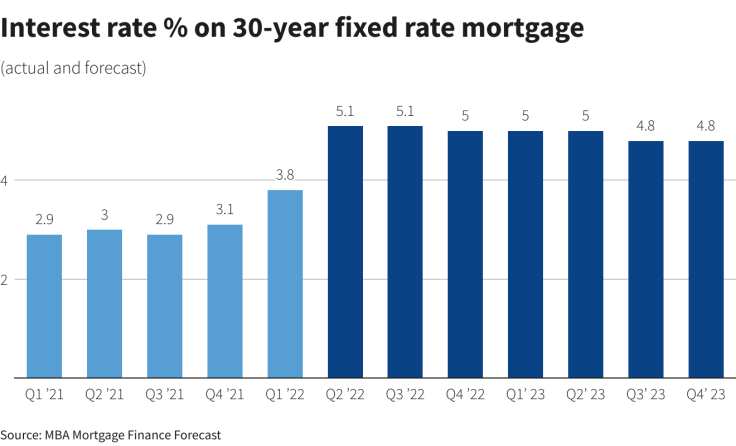

And as the rate for the most popular U.S. home loan nears its highest level since November 2008, the effects may spread to mortgage companies as demand for refinancing wanes.

Interest rate % on 30-year fixed rate mortgage

JPMorgan Chase & Co, the largest U.S. lender, has started laying off employees in its mortgage arm, citing "cyclical changes in the mortgage market".

More than 1,000 employees would be affected by the move with about half of them moving to different divisions within the bank, a source familiar with the matter said.

Executives at mortgage firm loanDepot Inc said in an earnings call last month that they were expecting to cut headcount to manage costs as market volumes drop. A source at Ally Financial Inc said it was focusing on "prudent and essential hiring only".

Both firms added about 1,000 employees last year.

"There is almost no incentive to refinance. So that drop off in business, in addition to our view of slowing (home) sales, suggests there will need to be layoffs across the industry," Douglas Duncan, senior vice president and chief economist at Fannie Mae, said.

Even if home sales stabilize, refinance volumes are going to be significantly lower than where they were the last couple of years, Leonard Kiefer, deputy chief economist at Freddie Mac, said.

The Southern, Midwest and Western parts of the United States will likely see more housing-related job losses than other areas as they significantly ramped up construction since the pandemic, Olu Sonola, Fitch Head of US Regional Economics, said.

On Thursday, Texas-based mortgage lender First Guaranty Mortgage Corp said it had filed for Chapter 11 bankruptcy and filed a WARN (Worker Adjustment and Retraining Notification Act) notifying layoffs of 428 employees.

Homebuilders, who are already reeling under labor shortages, may not announce layoffs due to backlogs, Sonola said.

To be sure, healthy backlogs at some homebuilders, who have learnt their lessons from the global financial crisis of 2008, show it is not all doom and gloom.

"There's still a lot of people who want a single family home," Dietz added.

And some sub-sectors like manufactured homes and recreational vehicle (RV) sites may be insulated from the job cuts as most residents are retired, CFRA analyst Kenneth Leon said.

© Copyright Thomson Reuters 2024. All rights reserved.