What Concepts Of Real Estate Are Applicable In The Metaverse?

The metaverse holds great promise for real estate developers. However, it can be hard to navigate the niche. While exciting, the space also may pose certain risks for beginners who do not know the relevant rules.

In this guide, we will outline the principles of real estate in the metaverse to help you get started with development and investment in this frontier. These principles will guide you toward building your fortune in this exciting new space.

Potential vs Actual Size

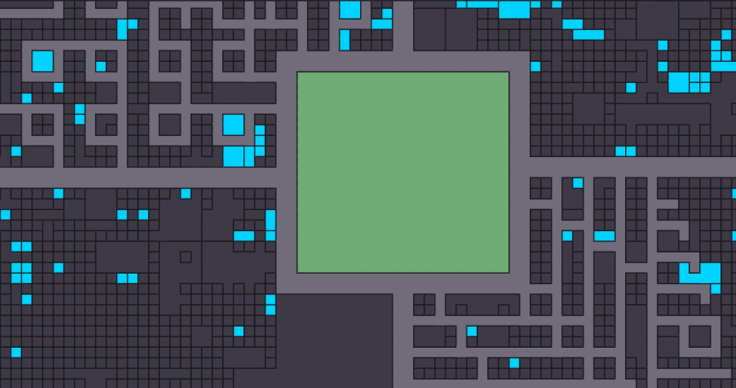

The amount of virtual real estate available isn't necessarily indicative of how much physical space your property can hold. Each parcel is measured according to its x, y and z coordinates; however, it's up to you (or your realtor) whether to use the entire space or not.

For instance, if you own a 96-meter by 96-meter lot but only plan to build a 50-meter by 50-meter house on it, you still have 46 meters of unused space. You could even subdivide your land into smaller parcels for sale to other players.

Buyer Beware!

The metaverse is still in its development stage, and many features, like all digital properties, are largely unregulated. This might cause uncertainty among users.

This principle frequently sets the burden of proof on buyers to inspect property fairly before purchasing it and accept responsibility for its condition. This is true for products that do not have a substantial warranty.

The What If? Principle

Ultimately, real estate in the metaverse is still a business transaction. If you don't have an answer to "what if?," then you shouldn't be entering into that deal. It may sound simple, but it can save you a lot of time and money — and headaches — in the long run. Maybe your potential new property comes with some advantageous changes to your bottom line.

Maybe some changes could harm your business if things don't go according to plan? Make sure you know what those are before making any deals. The principle applies not only to potential purchases but to leases as well. Terms of a lease aren't set in stone; they can change depending on how much negotiation power each party has. Make sure you know what could happen if things don't work out as planned.

Purchase and HODL

The virtual real estate market, like the rest of the crypto world, is prone to a lot of volatility. However, in recent years, the "business" has seen tremendous capital appreciation. For example, virtual property prices increased by about 500% after Facebook changed its name to Meta and announced its desire to dive head-first into virtual reality.

Announcing @Meta — the Facebook company’s new name. Meta is helping to build the metaverse, a place where we’ll play and connect in 3D. Welcome to the next chapter of social connection. pic.twitter.com/ywSJPLsCoD

— Meta (@Meta) October 28, 2021

Virtual real estate, like actual estate, necessitates a great deal of patience and time. In the metaverse, successful investors will need to be foresighted, looking to profit and grow their holdings over time.

It's all about capital appreciation in metaverse real estate. Investing in digital property involves purchasing it for the long term, i.e., Buying and HODLing.

Money Is Only As Good as What You Can Do With It

It's no secret that purchasing land and homes within a virtual environment can be expensive. In addition, many users are required to pay transaction fees on their properties, which means you might see smaller or nonexistent returns on your real estate investment at first. However, just like with anything else in life, what you do with your assets counts. Using property as collateral for a loan is a way people can use their homes for more than just fun and reap financial rewards.

Market value, capitalization rate, occupancy rate and cash on cash return are important numbers to watch out for. These numbers function almost identically in virtual real estate as they do in the real world.

Being Creative With the Space

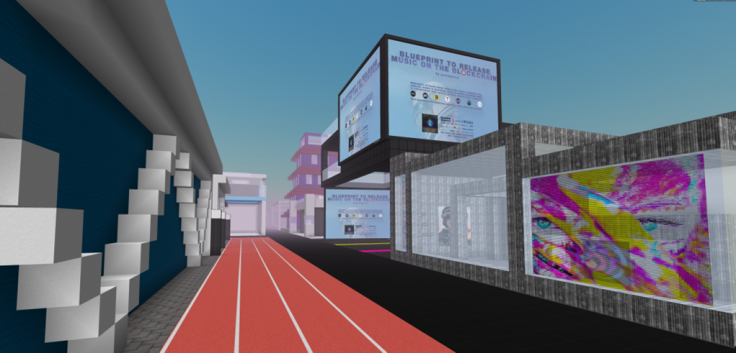

All of these real estate principles can be followed from within your virtual apartment, so think outside of your living space. You already know what part of your virtual property you plan to rent out, whether it's empty land, a structure or space on a billboard if you meticulously planned your metaverse land purchase. Consider different ways you can contribute and make a living off your property.

For example, if you own a restaurant or bar, you could consider opening up a business at night for people who want to hang out with friends and have drinks without going anywhere else. Or rent out your apartment for extra income when you're not using it! And remember that we are still early in VR technology — there are bound to be new developments on how we interact with our spaces that will change how we use them over time.

Location Matters

Keep in mind that your examples don't have to be an exact fit; a profitable virtual real estate enterprise depends on location. It's all about capital appreciation while investing in metaverse real estate. The importance of picking the correct location for your metaverse make-believe home cannot be overstated.

You can go from one section of the metaverse to another with a single click of a button. However, the industry adopts an asset-based valuation model, which treats Metaverse economics similarly to physical real estate. This concept necessitates potential property owners to research the prices of virtual plots on several marketplaces. They must also comprehend what makes land valuable in each metaverse.

The Land of Virtual Living: Metaverse Real Estate

In the massively popular NFT realm, metaverse real estate is the next big thing. More businesses and individuals are becoming involved, resulting in record sales and higher NFT prices.

For those interested in dabbling in the field, it's advisable to follow these basic rules of virtual real estate as you work to become the next virtual property magnate in the metaverse.

Whether it is creating stores, art galleries, gaming arcades or just simply owning properties, virtual land on the metaverse is surely on people's minds. Nonetheless, despite the virtual world's catchy headlines, it is upon an investor to exercise due diligence before injecting any funds into the space.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.