$XRP Sees Slight Pump Amid Anticipation For SEC Acknowledgment Of Grayscale ETF

KEY POINTS

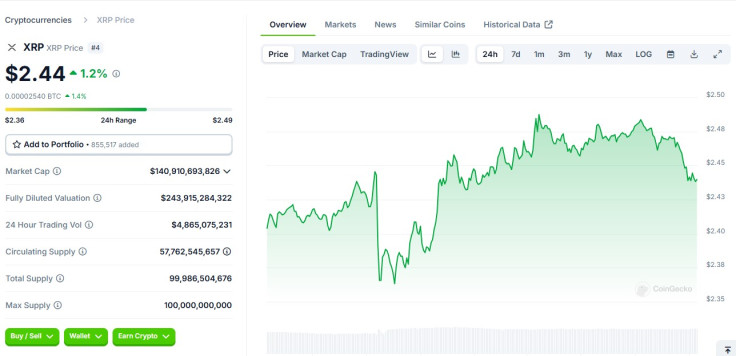

- XRP was up 1.2% in the day as "$XRP ETF" continued to trend on X from Wednesday through early Thursday

- NYSE Arca filed to convert Grayscale's $XRP Trust into an $XRP ETF late last month

- The SEC has a deadline of 15 days to acknowledge 19b-4 filings, unless it delays a decision

- Some crypto users aren't so hopeful due to spot Bitcoin ETFs taking a decade before getting approved

XRP slightly increased late Wednesday through early Thursday, as the XRP Army expressed excitement over reports that the U.S. Securities and Exchange Commission (SEC) may acknowledge Grayscale's application to convert its XRP Trust into an XRP exchange-traded fund (ETF).

The native cryptocurrency of the XRP Ledger hit the green late Wednesday and was up 1.2% in the day as other crypto assets like Bitcoin and Ethereum were also gradually on the rise.

$XRP ETF trends on X

The topic XRP ETF has been trending on X since early Wednesday, following the consecutive acknowledgements the SEC made for several crypto ETFs, including proposals for Solana (SOL) and Litecoin (LTC).

XRP users are expecting the SEC to acknowledge a 19b-4 filing for Grayscale's proposed XRP ETF as soon as Thursday or at least before the week ends.

Their projection is based on the SEC's usual schedule of 15 days to acknowledge a 19b-4 filing by an exchange seeking to list and trade a crypto ETF -- unless it delays the decision as the previous SEC leadership has done. The NYSE Arca exchange filed to convert asset manager Grayscale's XRP Trust into an ETF on Jan. 30.

Some XRP users noted how, unlike other cryptocurrencies whose legal status was yet unclear, the XRP token "has clarity."

On the other hand, XRP was only cleared as a non-security when offered on exchanges, as per a 2023 court ruling, with institutional offering yet to be clarified.

Others are urging the SEC, which is under a new leadership following the resignation of Chair Gary Gensler last month, to just acknowledge the filing sooner "to show good will."

An SEC acknowledgment does not indicate approval for trading, but is simply part of the process toward potentially approving the proposed ETF. The proposal still needs to go through a public feedback process and further review by the SEC before the final approval or denial is given.

The big difference is, this time, the new SEC is moving much faster than when the agency was led by Gensler. The acknowledgments on other proposed crypto ETFs came sooner than expected, increasing hopes that more crypto ETFs will hit the market soon.

Still, there are some who believe the XRP Army shouldn't drive their hopes too high. After all, approvals for spot Bitcoin ETFs took a decade.

"SEC be sayin' they 'acknowledged' a filin', but that don't mean they approve it, savvy? Look how long me waited for that #Bitcoin ETF, arr! Brace yerself for delays and theatrics, matey! ⏳"

— Pearl Diver (@PearlDiver_O) February 12, 2025

Ripple's case emerges in the conversation

As crypto users continued to discuss the potential acknowledgement this week, some users were also asking whether filings for XRP ETFs will have an impact on the SEC's lawsuit against Ripple, the top corporate holder of the XRP coin.

Even with the 2023 federal ruling regarding XRP's status, the case has yet to officially end. For many XRP holders, the lawsuit's final end could catapult the altcoin to unprecedented highs.

Meanwhile, there are also calls for BlackRock to file for an XRP ETF.

If BLACKROCK files for an $XRP ETF,

— TheXRPguy (@TheXRP_guy) February 12, 2025

THE PRICE OF XRP WILL NEVER BE THE SAME AGAIN

Once blackrock sees the volume on ETF from grayscale they will want a piece of $XRP

— ⚽️♥️♣️TerraCasino♦️♠️🔥 (@TerraCasino_io) February 12, 2025

BlackRock is a spot Bitcoin and Ethereum ETF issuer. Its BTC ETF was unchallenged in terms of inflows over the past year. Several other crypto ETF issuers have already filed for an XRP ETF, but BlackRock has yet to signal whether it is also interested or not.

© Copyright IBTimes 2024. All rights reserved.