Bitcoin Weekend Recap: Challenging $65K After SEC Approves BlackRock IBIT Options Trading

KEY POINTS

- Bitcoin has been rallying by more than 7% throughout the past week

- The SEC approved options trading for $IBIT on Nasdaq last week

- Spot Bitcoin ETFs, led by $FBTC, had a week-long haul of nearly $400 million

- Crypto observers expect $BTC to have a good Q4 it holds on to the green flag this month

The world's largest cryptocurrency by market cap is on a roll following a weekend of positive vibes from a hopeful community and news that the U.S. Securities and Exchange Commission (SEC) has approved BlackRock's spot Bitcoin exchange-traded fund (ETF) options listing.

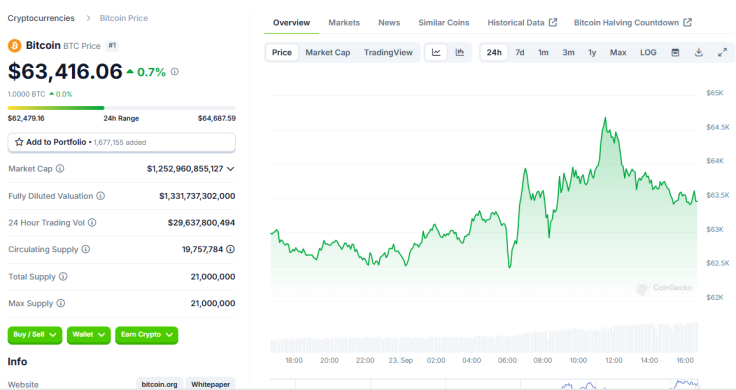

Bitcoin has gradually climbed in recent days, and on Sunday, surged at one point above $64,600. It remains in the green as of early Monday and is trading at around $63,400, data from CoinGecko shows. Why did Bitcoin have a good weekend, and why is BTC up today?

Bitcoin's Week-long Rally

Before its strong weekend performance, the world's first decentralized digital asset had been on a 7.7% increase in the past seven days. It has also been up by over 15% in the past 30 days, as per CoinGecko data.

BTC prices surged mid-week last week after the U.S. central bank cut its key lending rate by 0.5%, marking its first cut in over four years. From $59,000, Bitcoin spiked to a little over $62,000, triggering a wave of positivity in the crypto community.

Since then, many BTC holders have been made positive projections and expressed hopes that even with September being a historically weak month for the digital currency, it could be different this year.

SEC OKs IBIT Options

Also, last week, the SEC approved options trading for BlackRock's IBIT on Nasdaq, marking another milestone in the journey of spot BTC ETFs. It is unclear whether the regulator will also approve the listing and trading options for other spot Bitcoin ETFs on other U.S. exchanges.

On the other hand, Bloomberg senior ETF analyst Eric Balchunas assumes "others will be approved in short order." He noted how IBIT's milestone is a "huge win" not just for BlackRock but for the entire BTC ETF circle as it will attract more liquidity and, in turn, "more big fish" will be interested.

I'm assuming others will be approved in short order. Huge win for the the bitcoin ETFs (as it will attract more liquidity which will in turn attract more big fish). This is nice surprise re timing but not a shocker as @JSeyff and I gave 70% odds of approval by end of May. pic.twitter.com/a8mUGLOcKG

— Eric Balchunas (@EricBalchunas) September 20, 2024

Balchunas noted that even with the SEC's approval, the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC) also need to give the green light before IBIT options are officially listed.

$BTC ETFs End Week Positively

The string of good vibes around Bitcoin truly extended to ETFs, as the funds logged $92 million in positive flows Friday, as per data from Farside Investors. Its week-long total hit almost $400 million.

Notably, there was only one day last week wherein spot Bitcoin ETFs saw outflows. Fidelity's FBTC led the inflows most of the week, with Bitwise's BITB in second place.

Positive September for a Positive Q4?

Long-term crypto investor Jelle, who has a strong following on social media, said Bitcoin is currently on track "for the strongest September performance in history." He expects the last quarter of the year to end in the green if BTC holds and closes September in the green.

#Bitcoin is currently on track for the strongest September performance in its history.

— Jelle (@CryptoJelleNL) September 23, 2024

Close this month in the green, and the odds are high October, November and December will close green as well 👇🏼

Q4 looks promising. Very promising. pic.twitter.com/tNx5ZBCp2Y

Prominent crypto trader Ash Crypto believes a BTC bull run will start "in a few days," and Bitcoin YouTuber Crypto Rover said the upcoming cycle "will be so worth the wait."

© Copyright IBTimes 2024. All rights reserved.