The top after-market NASDAQ stock market gainers are: Andatee China Marine Fuel Services, Cumberland Pharmaceuticals, Finisar, Tianli Agritech, BSquare, Stereotaxis, Tandy Brands Accessories, EDAP TMS, Rex Energy, and Planar Systems.

Stocks, through quantitative easing, are pushed higher and into bubble territory. In a few years, the market could crash and fall as much as 50 percent, said Jeremy Grantham of GMO LLC.

Jim Cramer, a financial pundit and former hedge fund manager, said the best way of making money off the G20 Seoul summit is betting it won't go well. And one bets against the summit by buying gold, he said.

Copper hit record highs in London and jumped to a 30-month high in New York on Thursday as strong Chinese data suggested higher demand for the metal by the world's biggest consumer.

U.S. stocks declined in early trade on Thursday with tech stocks particularly remaining weak as weaker-than-expected sales and revenue forecast from Cisco Systems weighed on the sentiment.

MetLife Inc., the largest life insurer in the U.S., said it plans to discontinue the sale of new Long-Term Care Insurance (LTCI) coverage next year, citing ongoing financial challenges facing the LTCI industry.

Oil rallied to its highest in more than two years on Thursday on reports that major oil consumers may use more of it next year. Oil rose despite a strong dollar on the day, which analysts largely attributed to the latest demand-supply equations of the commodity.

The top pre-market NASDAQ stock market losers are: Cisco Systems, Micromet, Solarfun Power Holdings, RINO International, Ascent Solar Technologies, Cavium Networks, Limelight Networks, Clean Energy Fuels, Altera, and CoStar Group.

The top pre-market NASDAQ stock market gainers are: China GrenTech, Dendreon, Geron, A123 Systems, TiVo, Foster Wheeler, DryShips, Approach Resources, and Hudson City Bancorp.

The euro dropped across the board on Thursday as weak data from the region showed the crisis-hit EU member countries will continue to pressurize the single currency.

Media giant Viacom reported better-than-expected quarterly profit as it recorded strong gains in advertising, affiliate and television license fees.

Futures on major U.S. indices point to a lower opening on Thursday as weaker-than-expected sales and revenue forecast from Cisco Systems weighed on the sentiment.

Futures on major U.S. indices point to a lower opening on Thursday. Futures on the S&P 500 are down 0.38 percent, futures on the Dow Jones Industrial Average are down 0.27 percent and Nasdaq100 futures are down 0.66 percent.

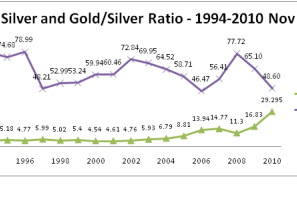

A study on charts shows that silver may not continue to enjoy the status of better investment alternative over gold in the short to medium term period.

The top after-market NASDAQ stock market losers are: SurModics, Cisco Systems, Ascent Solar Technologies, Cavium Networks, Micromet, Stereotaxis, Kulicke & Soffa Industries, Optimer Pharmaceuticals, Altera, and NetLogic Microsystems.

British private equity firm 3i Group Plc reported a profit and a rise in net asset value for the first half, and it lifted its interim dividend by 20 percent to 1.2 pence.

The top after-market NASDAQ stock market gainers are: China GrenTech, Perceptron, Sonic Solutions, Brooks Automation, Fuel-Tech, Prospect Capital, Dendreon, FiberTower, and China Sunergy.

Indian equity markets are trading lower by 29.17 points or 0.14 percent on Thursday with consumer durables, metal, healthcare and auto sectoral indices are in the gaining side and telecom, IT and realty sectoral indices are in the negative side.

Experts at PIMCO, which has the world's largest bond fund, said inflation is a medium and long term concern and investors should therefore consider purchasing more inflation-sensitive assets.

Futures on major U.S. indices remained range bound on Wednesday ahead of key weekly U.S. jobs data and September trade balance reports from the government.

QE2 is a rising tide that lifts all boats. The boats, in this case, refers to asset prices. Unfortunately, some asset rallies, particularly those in consumer and industrial commodities, are bad for the real economy,

he first U.S. exchange-traded fund (ETF) investing in companies that produce rare-earth elements and other strategic metals began trading this morning on the NYSE.

A Chinese research center has unveiled the Tianhe-1A, replacing United States as the maker of the world's fastest supercomputer.

Futures on major U.S. stock indices point to lower opening on Friday ahead of key U.S. monthly non-farm payrolls and unemployment data from the government.

The central body of the aircraft will allow passengers to the see the stars above and city lights below.

Global demand is increasingly shifting to emerging economies, and American firms, especially small businesses, should adjust to this new reality.

Foreign Direct Investment (FDI) in China spiked up for 13th straight month in August, despite complaints from the US and European companies over alleged unfair business environment and the Chinese government's favors for domestic firms.

For big U.S. banks, Basel III will likely have limited impact in the short-term because of its generous phase-in timeline

Robert Prechter speaks to IBTimes about mass psychology in the financial markets and specifically about the Greek sovereign debt crisis.

Douglas Clayton, chief executive officer of private equity fund manager Leopard Capital, has launched his second fund focused on Cambodia.