A British non-profit organization Raspberry Pi Foundation has the answer, in the form of a computer the size of a USB key priced at $25 – which could arguably be the cheapest computer on the block.

Oil rebounded by more than $4 on Monday, helped by a weaker dollar as the euro strengthened and bargain hunting by traders and investors after Brent crude lost almost $17 last week.

Oil rebounded by more than $3 on Monday, helped by a weaker dollar as the euro strengthened and bargain hunting by traders and investors after Brent crude lost over $16 last week.

Oil rebounded on Monday, up over $3 helped by a weaker dollar, rising Asian equity markets and bargain hunting by traders and investors after Brent crude lost over $16 last week.

Oil prices rose on Friday, bouncing up $3 in a slight rebound from a 10 percent crash the previous session.

The steep slide in oil prices this week is welcome because crude above $120 a barrel may hurt the world economy, while crude at $90 to $100 is ideal, an OPEC delegate said on Friday.

Oil prices fell further on Friday, extending a 10 percent crash the previous day as fears about global economic recovery pushed investors to unwind commodities positions.

Oil prices fell on Friday, extending a 10 percent crash the previous day as fears about global economic recovery pushed investors to unwind commodities positions.

Oil prices fell 5 percent on Friday, extending a 10 percent crash on Thursday as fears about global economic recovery pushed investors to unwind commodities positions.

Oil prices fell 5 percent on Friday, after a 10 percent crash on Thursday, as fears about global economic recovery pushed investors to further unwind commodities positions.

Brent crude fell by more than $4 to near $117 a barrel on Thursday as fund managers and traders pulled money from across commodities markets on concerns about interest rate rises and demand destruction.

Brent crude oil dipped below $124 a barrel on Tuesday as the dollar rose from a three-year low and traders weighed the impact on the market of al Qaeda leader Osama bin Laden's death.

Osama Bin Laden's death is being celebrated, and everyone seems to repeat the conspiracy theory that he was indeed the mastermind behind the terror attacks of 9/11. But that was never proven, and there is not even evidence hinting at such a connection according to the FBI. It is very well possible that completely different organizations than al-Qaeda were responsible for the planning and execution of 9/11, and that the latter were merely one of the involved parties.

Even as silver prices are hovering near their all-time record high, there are some investors who ardently believe prices will continue to go upward. And then, there are people who think it's realistically possible that silver will breach an unbelievable $100 an ounce!

Brent crude oil edged above $124 a barrel Wednesday as support from a weaker dollar, ahead of a Federal Reserve statement expected to maintain loose monetary policy, countered rising U.S. inventories.

Oil rose above $124 a barrel on Monday, pushed higher by an escalation of violence in the oil-producing Middle East and post-election unrest in OPEC member Nigeria.

Oil prices rallied 3 percent on Wednesday as U.S. crude oil inventories fell for the first time in seven weeks and the dollar weakened further, fueling investor appetite for riskier assets.

Brent and U.S. crude oil futures rallied more than $2 on Wednesday, with Brent over $123 a barrel, helped by a weekly draw in U.S. crude inventories that confounded expectations for a stock build, and by a weaker dollar.

The CURRENT SURGE in silver prices worldwide might seem dramatic, but it's more measured - so far, at least - than the true silver bubble that went Bang! in Jan. 1980. Even so, you might as well call this a record price.

Brent crude oil futures fell below $120 on Tuesday for the first time in two weeks, pressured by concern over the economic outlook and the risk that high prices could erode demand.

Brent crude oil fell on Tuesday, slipping below $120 a barrel for the first time in two weeks, pressured by concern about the economic outlook and that high prices could erode demand.

Oil prices fell more than $2 a barrel on Monday to under $122 a barrel after OPEC ministers said high oil prices could place a major strain on consumer countries, and S&P revised its U.S. outlook to negative.

Oil prices fell more than $2 a barrel on Monday to under $122 a barrel after top exporter Saudi Arabia said it had cut output because it lacked buyers, and the dollar strengthened against the euro on eurozone debt fears.

Oil prices fell more than $1 a barrel on Monday to less than $123 after top exporter Saudi Arabia cut output because it lacked buyers.

Brent and U.S. crude fell more than $1.50 a barrel on Tuesday in on concerns demand may wane on high fuel prices and after Goldman Sachs advised investors to lock-in trading profits before oil and other commodity markets reverse.

Oil prices fell on Monday in choppy trading, pulling back after surging to 32-month peaks last week when the dollar swooned and as investors warily eyed an African Union plan to halt Libya's conflict.

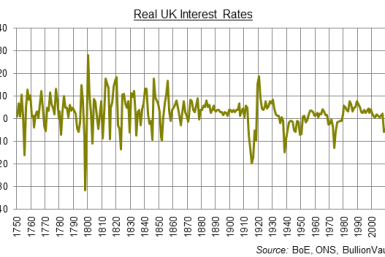

Backing money with gold isn't the problem for the legion of policy-makers and economists running the official monetary system. Raising interest rates is.

Silver is a very different market to gold. Most crucially, there's no commonly accepted benchmark value - such as a suit of men's clothes for an ounce of gold - against which to measure silver across time.

Oil hit a 32-month high above $124 Friday after attacks on Libyan oil fields raised the prospect of long-term supply cuts, with commodities in general rising on optimism global economic recovery will fuel demand.

Brent crude dipped on Thursday in Asian trade after five straight days of gains, slipping below $122 a barrel on concern that rising prices will hurt demand from the world's top oil consumers the United States and China.