Oil sank from 2-1/2-year highs near $120 a barrel on Thursday in strong, late-day profit-taking following an unsubstantiated rumor Muammar Gaddafi had been shot and Saudi Arabia's assurances it can counter Libyan supply disruptions.

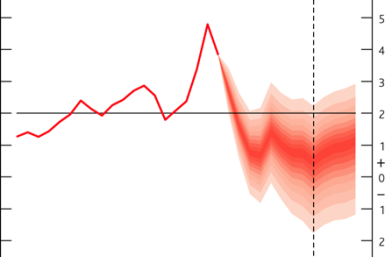

It’s no secret that speculators are buying up long contracts of commodities futures. However, the crowding of speculators in into one trade (in this case, long all kinds of commodities) usually spells an imminent reversal, especially if commercial users are on the other side of their trades.

Western investment banks are keen to underwrite more IPOs on China's Shenzhen exchange this year as a surging economy turns the once insignificant market into a fundraising hotbed.

Demand for gold and silver will remain high in 2011 owing to growth in physical demand and continued investor appetite, according to a Daily Markets analysis. It says the outlook for the precious metals remains bullish.

Apple Inc. is expected to release a new cheaper version of the iPhone during 2011 to deal with growing smartphone competition.

You can't really blame financial hacks for getting things so wrong, so often. Because every financial decision you now make is a speculation on interest rates. And so pretty much every story a financial journalist might choose to write must start and end with the same speculation, built on the inaction of each monthly central-bank vote.

More and more investors are flocking to silver, sensing an opportunity. Mark Thomas of the Silver Shortage Report wrote on Tuesday that Soros Fund management has made an investment in Pan American Silver (PAAS).

Global food prices have reached dangerous levels and have pushed an additional 44-million more people in the developing nations into poverty since last June.

About a quarter of Australia's sugar cane crop may have been destroyed after Cyclone Yasi tore through key growing areas, with the damage exacerbating already tight global supplies and helping push U.S. futures to three-decade highs last week.

A “severe winter drought” in China threatens to put wheat production at risk, stated a special alert from the Food and Agriculture Organization of the United Nations.

Ensco Plc

plans to buy rival Pride International Inc for about $7.3 billion in a deal that would create the world's second-largest offshore oil and gas driller.Global oil prices could exceed $110 a barrel if political unrest in Egypt continues, a member of Kuwait's Supreme Petroleum Council said on Sunday.

The bull market in Gold is in its 12th year (globally it began in 1999) but has yet to exhibit any bubble-like conditions. Institutional accumulation began in 2009 (e.g. Paulson, Einhorn) and we know that phase lasts at least a few years before a bull market gives birth to a bubble.

Whatever your finance advisor, economics professor, banker or coin dealer might tell you, no single asset class - bought today - can promise to hold or grow its value, year after year, until precisely the day when you need to sell it and spend.

Asian stocks rose on Tuesday, led by shares of resource companies, as strong U.S. factory data and surging commodities prices offset fears that unrest in Egypt could spread to other parts of the Middle East.

Asian stocks posted modest gains on Tuesday, led by shares in resource companies, as strong U.S. factory data and surging commodities prices offset fears that unrest in Egypt could spread elsewhere in the Middle East.

Brent oil futures climbed near $100 a barrel and Asian stocks fell on Monday, hurt by fears that deadly protests in Egypt may foment unrest throughout the Middle East and choke oil supplies, accelerating a move out of riskier assets.

Brent crude futures climbed near $100 a barrel on Monday and Asian stocks fell, hit by fears of unrest throughout the Middle East sparked by deadly protests in Egypt.

The Egyptian government should be responsive to its people's aspirations, the White House has said in measured but unusually strong comments about the raging anti-government protests in Egypt which forced the reported fleeing of the president’s son to Britain.

Some surprises, some yawns and some expected

The gold naysayers are using rising rates as a way to dismiss gold. Let me explain why this belief is not only false but also utterly dangerous. First and foremost, the parameters have changed in just a few short years. Government debt has increased substantially in the last few years.

Precious metals dropped to fresh multi-week lows on Tuesday helped by a view that rising overall investor confidence will cut safe-haven demand for the commodities while chartists turned history pages and 'decided to wait' for an additional discount of $30 for an ounce of gold, which is already $100 down from its peak seen less than two months ago.

Precious metals fell on Tuesday as a slew of data suggested better global economic environment, reducing investors' need to lock in their money in safer but less profitable avenues like metals while technical analysts see further room southward for the commodities.

Lately, we've noted the improving sentiment picture for Gold. As a market weakens, sentiment will naturally become less bullish. In this case, sentiment has weakened considerably yet Gold is only 6% off its high. Most interesting in particular is the divergence between the COT data for Gold and Silver and the rest of the commodities.

The yellow and white precious metals have pared most of Monday's Asian gains in North American trading but the metals see strong supports at current levels as the sharp correction in recent days have already brought them to technically justified points of entry.

Saudi Arabian Oil Minister Ali Naimi said on Monday that he expected oil markets this year to be in balance and price stability to continue at 2010 levels.

Silver prices could hit an incredible $120 in just three years, propelled by a physical shortage in the silver market and further momentum in economic recovery, CommodityOnline has reported citing a report by thesilvershortage.com.

OPEC's leading oil price hawk Iran joined Venezuela and Libya on Sunday to say it saw no need for the cartel to consider raising crude supplies to rein in crude prices now near $100 a barrel.

Speculation could push oil prices to rise to $110 per barrel within a few weeks, which may prompt OPEC to raise production, a member of Kuwait's Supreme Petroleum Council said on Sunday.

Oil prices fell further from 27-month highs on Wednesday as a stronger dollar sapped investor risk appetite for commodities, despite signs of tighter oil supply fundamentals.