With less than a day remaining before Twitter's hotly anticipated IPO, here's a roundup of the highest-grossing American public offerings.

After the outspoken financial commentator talked about Bitcoin on a BBC news show, the price of the digital currency went sky-high.

Boosted by ESPN ratings, theme-park attendance and the blockbuster “Monsters University,” the Walt Disney Company on Thursday is expected to report strong Q4 2013 results.

On the heels of its headline-making acquisition of Smithfield Foods, Shuanghui announces a $5 billion IPO.

Quarterly results could once again provide direction to markets ahead of Thursday’s GDP and jobless claims data.

A humanitarian disaster is avoided after a court tells Barclays it must continue to transfer money to Somalia despite terrorism fears.

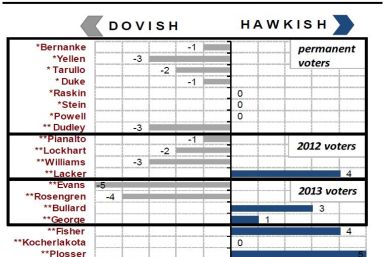

Goldman's top economist says it looks like Fed data favors lingering low rates.

Pimco's Total Return Fund lost billions this year thanks to the Federal Reserve's decision to taper bond buying.

After five years of misery, European banks are getting back in shape by shedding trillions in assets.

The $5.7 billion deal helps Abu Dhabi-based Etisalat to continue expanding overseas while Vivendi trims its worldwide operations.

Rising production costs in television and film may drag Time Warner's third-quarter profit.

Sustained growth in the service sector signals a stabilization in the UK's economy and puts it on track to meet growth expectations.

Company earnings could dictate market movements as a month-long rally that extended into November appears to hit a bump.

The roughly $400 million in ransom taken in from 2005 to 2012 helped fuel the local economy -- and more terrorism.

Outflows from gold-backed specialist funds totaled 48 metric tons, surpassing September and August combined.

The health-conscious, church-going hiker says she’s losing her health coverage for stage 4 cancer treatment.

Struggling international assets like Sky Italia and a lack of political advertising weigh on the media giant's year-on-year profits.

Nauru residents may finally obtain access to savings accounts, debit cards and credit cards after burying their cash in the dirt.

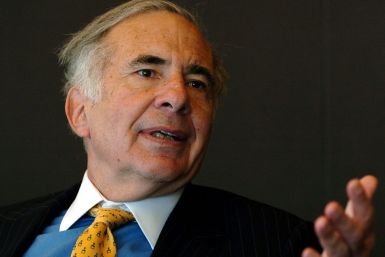

Hedge fund manager Carl Icahn said in a statement that activist investors will help keep U.S. companies competitive on world markets.

Will Janet Yellen's ascension to the head of the U.S. central bank help to extend the current rally in IPOs?

Steel companies could benefit from recently filed trade cases, Goldman Sachs says.

Steve Cohen has continued to avoid formal criminal charges as civil and criminal trials near conclusion.

After a solid performance last week and month, stocks look set to open higher. Earnings and factory data will hold market's interest.

Five years after the financial crisis, the head of TARP is doing her best to put bankers in jail.

Beijing's initial public offering freeze is not likely to end anytime soon, and it has implications for other markets.

After agreeing to deals involving fines of $18.1 billion in recent weeks, JPMorgan is now facing criminal investigations from the DOJ.

Big U.S. companies are seeking and finding lenders in a responsive corporate bond market.

British regulators are investigating Barclays, among other banks, on suspicion of tampering with global currency markets.

A relatively light earnings calendar at the end of a busy week will have markets watching data on manufacturing for direction.

Weighing the pros and cons of the new digital currency.