It will apparently take more than one terror attack to scare away foreign equity investors.

After decades of failed efforts to significantly boost clean energy use, the U.S. may have hit on a strategy that could actually work.

Investors remain in a wait-and-see mode until there's further hard evidence regarding the Fed's stance on stimulus as autumn begins.

The euro and the dollar are affected as central banks in the U.S. and the euro zone stuck to a dovish stance.

An Oxford University team discovered in a recent study that financial advice given to investors did not translate into profits or success.

Investors have one eye on the week's economic data, and the other on the U.S. budget/debt ceiling spat in Washington.

Myanmar has seen a lot of foreign investment as of late, but not so much from the U.S. just yet.

What’s more, the U.S. central bank’s purchases of bonds will probably come to an end in mid-2014, they say.

Here’s your chance to own a portion of an icon: The firm that owns the Empire State Building is going public and will sell shares in the market.

More electronic trading and changes to market structure worry S&P about global exchange operators.

However, despite just emerging from recession, analysts do not expect explosive economic growth in the near future.

JPMorgan paying $920 million for "London Whale" fiasco.

Talk about not letting a good crisis go to waste -- the U.S. Treasury's Capital Purchase Program (CPP),part of TARP, is now profitable.

In its statement, the Fed said, in effect, that it is not happy with the pace and extent of the U.S. economy's recovery.

Will the bailout of GM ultimately cost the U.S. billions of dollars? Probably.

Analysts at Goldman Sachs said 2013 prices aren’t great, but they're better than the prices we'll see next year.

Members unanimously kept the interest rate and asset-buying steady, noting that the jobless rate was not a "trigger" for policy decisions.

The Fed’s decision about its bond-buying program and clues to future monetary policy will be front and center for investors.

It's been a long time coming, but it finally looks like the Fed will slow down quantitative easing, but at whose expense and whose gain?

China is encouraging short-selling to help boost the markets, but it is doing so cautiously.

UK inflation dipped marginally, while economic sentiment in the euro zone and Germany, as measured by the ZEW index, improved sharply.

After the Crash of 2008, a lot of assets lost a huge amount of value, but most have bounced back -- save two.

A property tax seems inevitable for China's major cities, but levying such a tax could cost the nation some of its economic growth.

One Canadian company appears 72 times on the the World Bank's list of 250 globally blacklisted companies.

The analysts combined nine mostly quantitative methods to come up with the noteworthy 1900 figure.

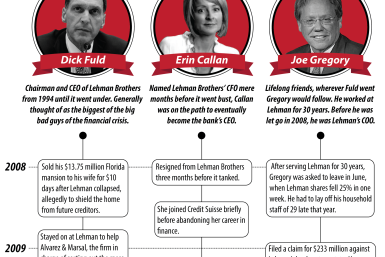

When Lehman Brothers collapsed, it took down the careers of Dick Fuld, Erin Callan and Joe Gregory, among others.

Even though the reduction in Fed stimulus will come as no surprise, next week is key for the gold market.

This may be Africa’s moment: Consider that mining may be one of the least of its many potentially lucrative assets and attributes.

However, the administration left open the possibility that the Nikkei report may end up being true.

Investors remain transfixed on economic data, the Fed's next move next week, and the Syrian crisis.