MicroStrategy Rebrands With Bitcoin-Inspired Logo Into Strategy, Posts $670M Q4 Loss

KEY POINTS

- Strategy also launched a new orange and black website where users can track $BTC prices and $MSTR stock performance

- Strategy posted a net loss of $670.8 million in Q4 2024 and its operating expenses ballooned to $1.103 billion

- Bitcoin slightly dropped in the hours after Strategy's rebrand and Q4 2024 financial report announcements

Tech firm MicroStrategy (MSTR) announced Tuesday it is rebranding into Strategy, and the new logo proudly displays the Bitcoin symbol, highlighting the company's BTC treasury strategy that has since been adopted by several other public-traded companies both in the U.S. and overseas.

Tysons-based MicroStrategy announced the rebranding as it reported its fourth quarter 2024 financial results, which saw the company logging a net loss of $670.8 million. The company also logged staggering operational losses in the previous quarter.

World's 'First Bitcoin Treasury Company'

In its rebranding announcement, Strategy said the move "powerfully and succinctly conveys the universal and global appeal of our company." It noted that Strategy is the world's "first Bitcoin Treasury Company" and will continue to push its BTC acquisition strategy forward.

Strategy Chief Financial Officer Andrew Kang said Q4 2024 marked the company's largest ever increase in quarterly BTC holdings. In the said period, the company acquired 218,887 Bitcoins for $20.5 billion.

The company also launched a new website, strategy.com, where consumers can monitor Strategy's Bitcoin treasury as well as the performance of the MSTR stock.

Strategy announces Q4 2024 financial results and launches new website https://t.co/zwmL0kNH16. Join us for our Earnings Call today at 5PM EST to hear more about our new brand, financial results, and outlook for our Bitcoin Treasury Company. $MSTR https://t.co/p1uovTN0sd

— Michael Saylor⚡️ (@saylor) February 5, 2025

Q4 2024 Financial Highlights

Strategy is known for being the world's largest known corporate holder of Bitcoin (not based on spot BTC exchange-traded funds). Its founder, Michael Saylor, is one of the cryptocurrency community's most prominent BTC maximalists.

The company is also known for making Bitcoin purchases regardless if the digital currency is up or down.

For the fourth quarter of 2024, Strategy saw staggering operating expenses of $1.103 billion, representing a 693.2% increase year-over-year. "Operating expenses include impairment losses on the Company's digital assets," Strategy noted. Strategy's impairment losses on its Bitcoin holdings were at $1.006 billion.

Losses Incurred Amid 'Cycle' Concerns

MicroStrategy's rebranding and Q4 2024 financial report come a few weeks after some critics raised concerns about the company's BTC strategy that relies on the digital currency's price growth.

For analyst Jacob King, Strategy's Bitcoin acquisition method is a "giant Ponzi" that will ultimately collapse once the world's largest cryptocurrency by market cap crashes.

Strategy has not responded to the said concerns and continued to snap up Bitcoins in the days following discussions on social media over the supposed loophole in the company's strategy.

$BTC Falls Even with Positive News

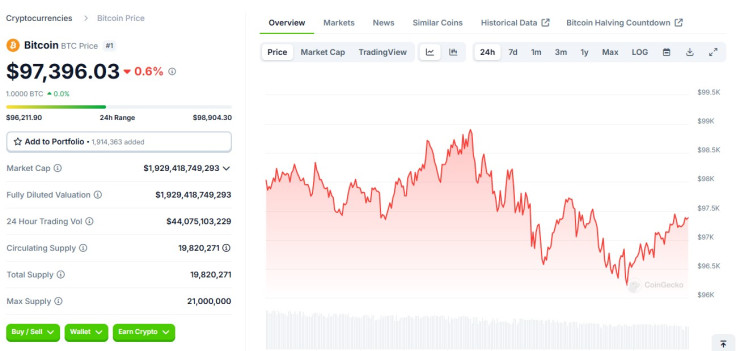

Meanwhile, Bitcoin appears to be unmoved by MicroStrategy's big announcement and rebrand. The digital coin is down 0.6% in the day and has decreased to $97,300 in the hours after the Strategy announcement.

In the early months of MicroStrategy's Bitcoin adoption, the crypto asset immediately showed a positive uptick whenever the company made BTC-related announcements. It appears Bitcoin is too affected by geopolitical events and the U.S. trade war to react positively to Strategy's big news.

© Copyright IBTimes 2024. All rights reserved.