In More Ways Than One, Fed's Powell Showed His Strategy This Week

With a war in Europe underway, a pandemic still locking down parts of the global economy and financial markets having turned sharply volatile, the U.S.

As Some States Hit Record Low Unemployment, Fed Faces Tough Adjustment

When Georgia matched its record low unemployment rate of 3.4% last October, officials in the southern U.S.

Market Volatility, Balance Sheet Surprises Raise Risk Of Bumpy Fed Pivot

The Federal Reserve is expected to approve plans next week to reduce a nearly $9 trillion balance sheet that ballooned as part of its efforts to fight the pandemic recession, in a process U.S.

Two-thirds Of Workers Might Seek New Jobs If Forced Back To Office - Global Survey

Worker demands for more flexibility and security, bolstered by the pandemic and a tight labor market, are only growing more intense as the world economy reopens and some firms begin trying to pull employees back to offices, payroll provider ADP reported in a survey of nearly 33,000 people worldwide.

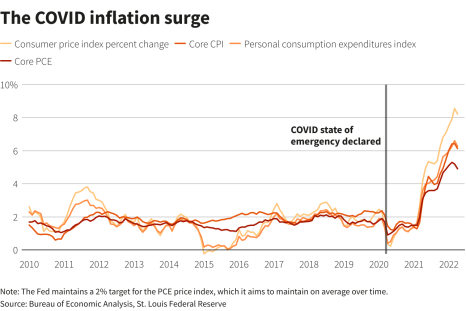

Broad Inflation Little Relief For Fed, But Peak May Be Near

U.S. consumer inflation hit another four-decade high in March when it reached 8.5% in large part on gasoline prices surging to a record, but the data sported enough soft spots for some Wall Street pundits to declare "peak inflation" was at hand.

Bullard: Fed "behind The Curve," Sees Rates Now At 3.5% By Year's End

The Fed is behind in its fight against inflation and needs to raise the federal funds rate another 3 percentage points by year's end, St.

St. Louis Fed's Bullard Says Fed Still Seems "behind The Curve"

The Federal Reserve remains behind in its fight against inflation despite increases in mortgage rates and government bond yields that have raced ahead of actual changes in the central bank's target federal funds rate, St.

Fed's Williams: Pace Of Rate Increases Depends On How Economy Responds

The Federal Reserve needs to move monetary policy towards a more neutral stance, but the pace at which it tightens credit will depend on how the economy reacts, New York Fed President John Williams said Saturday.

NY Fed's Williams: Balance Sheet Run-off Could Start As Soon As May

The Federal Reserve may begin trimming its balance sheet as soon as its May 3-4 meeting to address inflation risks that have become "particularly acute," New York Fed chair John Williams said Saturday.

U.S. Economy Not Letting War, Pandemic Get In The Way Of A Good Time

Fear that the war in Ukraine would tilt the U.S. economy towards a 1970s-style bout of stagflation has given way to signs that Americans plan to keep traveling, returning to restaurants, and continuing a steady if still incomplete return to "normal." .

Fed's Rate Path Balances Inflation Fight And Pandemic Unknowns, Barkin Says

The rate increases projected by Federal Reserve officials this week represented a "balancing act" between the need to begin normalizing monetary policy in the face of high inflation, while guarding against a fast tightening of credit that could damage the economy, Richmond Fed President Thomas Barkin said on Friday.

Fed Hawks Say More Dramatic Rate Moves May Be Needed To Tame Inflation

Two of the Federal Reserve's most hawkish policymakers on Friday said the central bank needs to take more aggressive steps to combat inflation, with one saying he would have supported a larger move this week were it not for the war in Ukraine and the other saying the geopolitical risks should not impede them.

Past Fed Hiking Cycles, From Sanguine To Severe, May Say Little About This One

U.S. politicians know high inflation can bring careers in public office to an early end, but it is ultimately up to the unelected officials of the Federal Reserve to control what is considered first and foremost a "monetary phenomenon." .

All Systems Go For Fed's Liftoff Of U.S. Interest Rates

The Federal Reserve on Wednesday will close the door on its ultra-easy pandemic-era monetary policy and step up the fight against stubbornly high inflation with the first in what is likely to be a series of interest rate hikes

Inflation Surge, War Cloud Fed's Interest Rate Trajectory

New economic projections from the Federal Reserve this week will show how far and how fast policymakers see interest rates rising this year, in a first test of the impact of the Ukraine war and surging inflation on the coming shift in U.S.

War, Pandemic, And Inflation Deal Fed A Complex Trifecta

In what now seem the simpler days of December, when there was only a pandemic to worry about, Federal Reserve officials rallied around the view they could tame inflation with modest interest rate hikes while the economy and labor market thrived.

Analysis-Oil Shock Is Coming, But U.S. May Have Already Paid For It

The gusher of money the U.S. government poured into family bank accounts during the coronavirus pandemic, credited with speeding the rebound from the health crisis, may now help limit the economic damage from Russia's invasion of Ukraine and give the Federal Reserve more leeway in raising interest rates.

Analysis-An Oil Shock Is Coming, But The U.S. May Have Already Paid For It

The gusher of money the U.S. government poured into family bank accounts during the coronavirus pandemic, credited with speeding the rebound from the health crisis, may now help limit the economic damage from Russia's invasion of Ukraine.

New Index Shows U.S. Inflation Expectations Shifting Higher

One-year U.S. inflation expectations have rocketed higher since Russia's invasion of Ukraine and the longer-term outlook has begun increasing as well, a development likely to be watched closely by the Federal Reserve as it battles to keep price pressures under control.

A Thaw In U.S. Jobs Market Could Be Good News For Fed's Inflation Battle

It was just a hint of something good on the horizon, Richmond Federal Reserve President Thomas Barkin said this week, but in his recent conversations with business officials they have been suddenly upbeat about the number of applicants for open jobs.

Fed's Powell: Ukraine War Impact Uncertain But Could Hit Spending, Investment

Russia's war in Ukraine could hit the U.S. economy across a variety of channels from higher prices to dampened spending and investment, Federal Reserve Chair Jerome Powell said Thursday, though it is unclear what the ultimate impact will be.

Global Supply Pressures Eased In February, New York Fed Says

Global supply chain pressures eased in February as backlogs and delivery times improved in several key markets and a measure of ocean shipping costs declined, according to new data from the New York Federal Reserve released on Thursday.

Global Risks Cloud Fed's Policy Pivot As Powell Heads To Congress

The Federal Reserve's plan to end the loose money policies used to fight the coronavirus pandemic is facing an unexpectedly early test as the Russian invasion of Ukraine poses new economic and financial risks already being felt in global markets.

Fed, And Powell, Face A New World Of Risk In Pivot To Tighter Policy

The U.S. Federal Reserve's plan to end the loose money policies used to fight the pandemic is facing an unexpectedly early test as the Russian invasion of Ukraine poses new economic and financial risks already being felt in global markets.

Fed Warns Of Wage Pressures As Data Shows Inflation Still Rising

The Federal Reserve's preferred measure of inflation rose again in January and a new report from the central bank warned that price pressures could persist unless a shortage of available workers begins to ease.

Another Jump In Inflation Firms Fed Pivot To Higher Rates

The Federal Reserve's preferred measure of inflation rose again in January, likely firming the central bank's intent to raise interest rates through the year even as policymakers start to weigh the possible impact of the Russia-Ukraine conflict on the economic outlook.

Ukraine Crisis May Slow, But Not Stop, Fed Hiking

The U.S. Federal Reserve's battle against inflation, already complicated by the unpredictable impact of a once-in-a-century pandemic, now faces a likely energy price shock and another layer of uncertainty following Russia's military move into Ukraine.

Fed's Evans Says Policy "wrong-footed," But May Not Need To Be Restrictive

Current high inflation requires a "substantial repositioning" of Federal Reserve policy, but not so much that it will restrict the economy and wreck employment, Chicago Fed president Charles Evans said Friday.

Fed's Hopes For Low Inflation And Lots Of Jobs May Fall Flat, Economists Say

When the Federal Reserve tacked to a new brand of monetary policy 18 months ago it thought it could deliver low unemployment and tame inflation.

Fed Minutes Likely To Provide Details On Rate Hikes, Balance Sheet Reduction

The release on Wednesday of the minutes of the Federal Reserve's last policy meeting is likely to shed light on the U.S.