European data released Monday show Spain manufacturing flat but not shrinking, while the euro-zone jobless rift is widening.

Gold rallied on the last day of the second quarter, but it was a case of too little, too late.

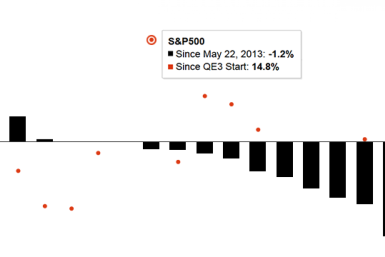

By hinting at a QE expiration date, Bernanke has essentially hit the reset button on the global financial system. But it’s all for the better.

Roger Altman, founder of Evercore Partners, appeared on CNBC, offering his opinions on why gold is down in the markets. Watch what he had to say here.

Precious metals fell again Wednesday on continued concern about China's cash crunch.

India's central bank imposed restrictions on lending against gold by rural banks to discourage demand and reduce imports.

The president of the St. Louis Federal Reserve Bank urged the U.S. Federal Reserve not to taper just yet.

Can the chairman of the world's most powerful central bank still sway markets with his words? Take a look.

U.S., German and French stocks fell, on average, about 2.5%, as investors fled the markets on fears the Fed will turn off the money spigot.

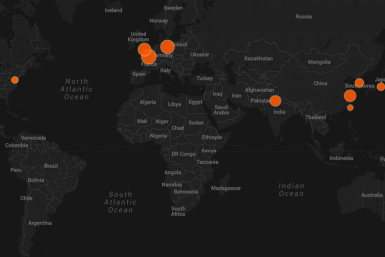

The price of gold has fallen by nearly one-third since October 2012 - but where is the world's most precious metal headed from here?

The cut, while painful for many Indonesians, may be necessary for a more stable economy in the future.

This is how influential the chairman of the Federal Reserve is.

However, the Fed said downside risks to the economy and job market have "diminished since the fall."

Which types of U.S. investors will gain when the Federal Reserve eventually tapers -- i.e., decreases -- its quantitative easing program?

In the past year, prices are up 1.4% - or well within the Federal Reserve's "comfort zone" for inflation.

U.S. stock index futures gain as markets await reports on inflation and housing starts.

Investor sentiment in Germany and the euro zone improved more than expected while inflation in the UK rebounded, data released on Tuesday show.

The gold price rally in the late 1970s turned out to be a bubble. Societe Generale thinks this time is not much different.

India's central bank left benchmark rates untouched on Monday as softening inflation is offset by currency and deficit concerns.

The latest European Union inflation and unemployment data show the continent's economy is still struggling to recover.

U.S. stock futures point to a flat open on Friday as investors await a host of economic data.

Gold prices are expected to fall further as a sell-off in ETFs backed by the precious metal extended to 17 weeks.