The U.S. Federal Reserve Wednesday lowered its view of the U.S. economy, but kept interest rate policy and its non-traditional quantitative easing policy the same. The Fed said it now sees "economic activity decelerated somewhat over the first half of the year," compared to a previous view of the "economy has been expanding moderately."

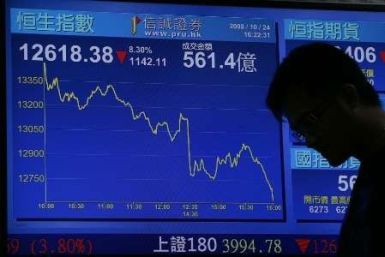

Most of the Asian markets fell Wednesday amid increasing concerns over the slowdown in economic growth in China as the country's manufacturing activity grew at a slower pace in July compared to that in the previous month.

The jobless rate in the U.S. has stubbornly remained above 8 percent for more than three years, and the labor market likely saw little improvement in July, economists say in anticipation of the July nonfarm payrolls report due Friday.

Most of the Asian markets rose Tuesday as investors remained hopeful that the world's central banks would announce stimulus measures soon to help boost the global economic growth.

U.S. stock index futures point to a lower opening Monday as investors remained cautious while waiting for the central banks around the world to announce stimulus measures to recover the economic growth.

U.S. stock index futures point to lower opening Wednesday as investors were disheartened after the Federal Reserve gave no indication of stimulus measures to boost the economic growth.

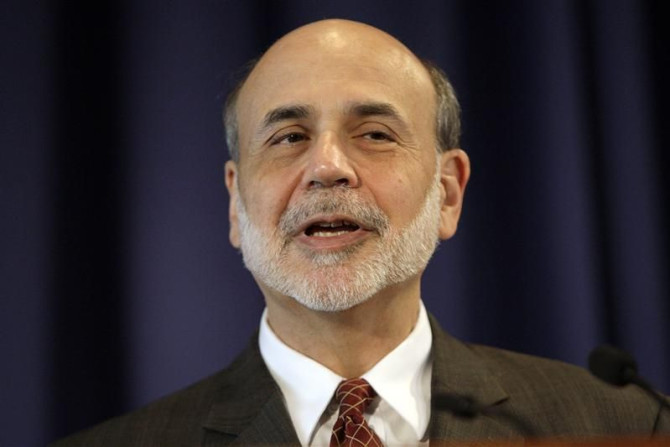

Asian stock markets were mostly lower Wednesday as the lack of explicit hints about further quantitative easing from Fed Chairman Ben Bernanke during his congressional testimony disappointed investors.

The head of the world's most powerful central bank said it stands ready to offer additional monetary support to a U.S. economy that has slowed significantly in recent months, U.S. Federal Reserve Chairman Ben Bernanke told lawmakers on Tuesday.

Gold experts have further cut back price forecasts for the metal this year after a sluggish first half, a quarterly Reuters poll showed on Monday, while gains in the dollar and a dearth of physical demand are likely to clip any attempted return to last September's record high for the rest of the year.

Copper prices have outperformed the overall metals market as traders have closed short selling in expectation of government intervention to boost growth, but the metal may still be slightly overvalued, according to a Monday report by Barclays.

Dennis Lockhart, president of the Federal Reserve Bank of Atlanta, said Friday he might support more central bank attempts to stimulate the nation's moribund economy.

Most European markets fell Thursday as investor sentiment continued to be negative over increasing concerns of the faltering global economic situation and deepening debt burden of the euro zone.

Crude oil prices lowered slightly and hovered above $85 a barrel in Asian trade Thursday, as investors opted for caution ahead of the Chinese GDP data.

U.S. stock index futures point to higher opening Wednesday, but investors remain watchful amid concerns that the sluggish global economy and the euro zone debt burden will hurt the earnings of companies.

U.S. stock index futures point to a lower opening Monday, as investor sentiment remained fragile amid concerns of a gloomy global economic outlook.

Asian stock markets declined Friday as investors remained cautious ahead of U.S. employment data due later in the day while major central bank?s actions to stimulate the global economy failed to calm market jitters.

European markets fell Friday as investors were not encouraged by the rate cuts announced by central banks.

The price of gold was losing value on Thursday in as the U.S. dollar strengthened

Yesterday the Fed announced that they will extend their yield curve 'twisting'

Crude oil futures declined Thursday, weighed down by an unexpected jump in the U.S. crude supplies and the Federal Reserve's limited help to revive the domestic economy.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

Asian stocks struggled and commodities fell broadly on Thursday after the Federal Reserve ramped up monetary stimulus by expanding Operation Twist, but disappointed some investors who had been hoping for more aggressive measures.