2 US Bitcoin ETFs Dethrone MicroStrategy As Largest Corporate Holders Of $BTC

KEY POINTS

- IBIT leads the pack with over 316,000 Bitcoin holdings, followed by GBTC with over 273,000

- Fidelity's FBTC is catching up to MicroStrategy, with nearly 177,000 Bitcoins

- Spot Bitcoin ETFs hauled in over $310 million on Friday to record a six-day positive flow streak

Over six months since launching, two U.S. spot Bitcoin exchange-traded funds (ETFs) have overtaken MicroStrategy as the largest corporate holders of the world's top digital asset by market cap. This comes as another ETF catches up to MicroStrategy, once king of the $BTC holders in the corporate world.

MicroStrategy loses crown

Since launching in January, BlackRock's IBIT has become the most popular U.S. spot Bitcoin ETF. A chart posted Sunday night by well-followed analysis account @HODL15Capital showed that IBIT now holds 316,284 $BTC worth some $19.8 billion based on current prices.

IBIT isn't the only Bitcoin ETF gaining ground. Grayscale's GBTC now holds 273,726 Bitcoins. The ETF wasn't a very popular choice among retailers due to its high management fee but has gradually gained traction among institutional investors in recent months.

IBIT and GBTC's holdings are both larger than that of MicroStrategy, which was once the world's largest corporate holder of the digital asset, at least among public companies. Michael Saylor's company now holds 226,331 $BTC after it offered senior notes to snap up more tokens last month.

MicroStrategy may lost Top 3 spot

So far, MicroStrategy is comfortably sitting on the third spot in the ranks. However, Fidelity's FBTC is fast catching up, with 176,992 $BTC holdings. Tether, the company behind the world's largest stablecoin, $USDT, has 75,354, and ARK 21Share's AKRB holds 47,764 Bitcoins.

Bitwise CIO Matt Hougan believes spot Bitcoin ETFs are "just getting started" even if they already saw some $15 billion in net new assets since going live. If his prediction turns out to be true, MicroStrategy may soon lose its Top 3 position to FBTC and other Bitcoin ETFs.

No stopping ETFs?

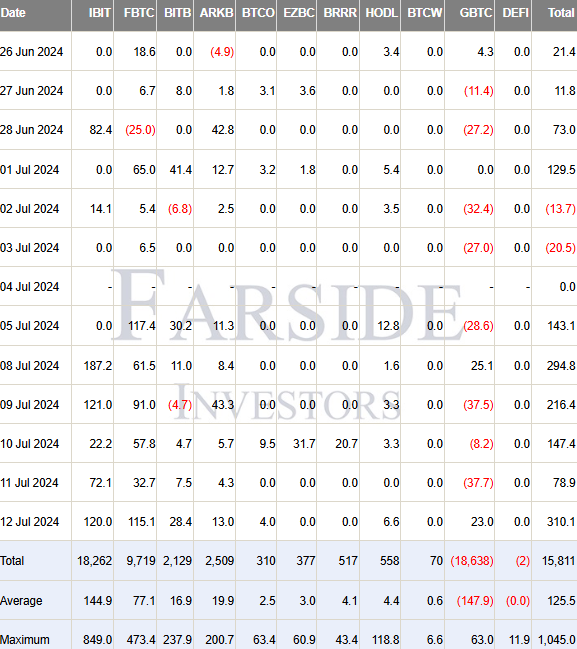

On Friday, U.S.-listed $BTC ETFs saw a stellar $310.1 million positive flow, marking its sixth consecutive day of positive net flows, as per data from London-based investment management company Farside Investors. As with earlier days in the week, IBIT led the pack, hauling in $120 million, followed by FBTC, with $115.1 million accumulated.

Laying low to regroup

Before last week's rally, $BTC ETFs saw significant outflows that raised questions about the stability and longevity of the funds. However, when prices fell below $55,000 amid the German government's selloffs of its seized Bitcoin stash, the funds moved to buy the dip.

As of Saturday, the global spot Bitcoin ETF industry holds 1,051,569 $BTC. While U.S. funds still account for most of total holdings, global ETFs such as the Canadian Purpose Bitcoin ETF and German BTCE are steadily stacking up.

© Copyright IBTimes 2024. All rights reserved.