Gold has posted a return of 8 percent for the year to date, compared to a 2 percent gain in the NASDAQ.

Coca-Cola has been through much, but investors should keep in mind the Wall Street axiom: "No one ever went broke, holding Coke."

As gold breaks free from narrow trading ranges, U.S. investors are once again showing interest in the metal as a form of insurance.

Global natural resources performed better than sluggish stocks and bonds for the year to date.

Four dairy farmers charged with animal abuse could end up in prison.

Gold, platinum and soybeans are among those markets most at risk, Goldman Sachs said.

Confusion over money laundering rules seems prevalent at a few gold dealers.

U.S. gold coin sales fell 40 percent in January from a year earlier.

Historically, institutional investors have favored gold. How about during the post-financial crisis era?

One quarterly stat institutional investors will scrutinize: Pepsi's sales in its declining North American beverage business.

Brazilian farm exports could surpass $100 billion in 2014, says the Agriculture Ministry.

ChannelAdvisor helps companies sell products online, and grew its revenue 30 percent in 2013, to $68 million.

The call to switch to gold mining stocks is increasingly popular among industry experts.

Political and economic volatility in Argentina has underscored how frontier markets can turn sour quickly.

Poultry regulation may feature prominently in 2014 on advocates’ agendas, after two critical December reports made waves.

The eye-catching statistic reflects China’s growing reliance on wheat imports to feed a nation of 1.35 billion people.

Analysts had expected a bumper harvest this year for the world’s largest producer of Arabica coffee beans, but the weather isn't cooperating.

The World Gold Council estimates that about 30 percent of the gold mining industry becomes unprofitable below $1,200 per ounce.

Interest from Mexico mirrors investments by Japanese pension funds, which have boosted gold holdings in recent years.

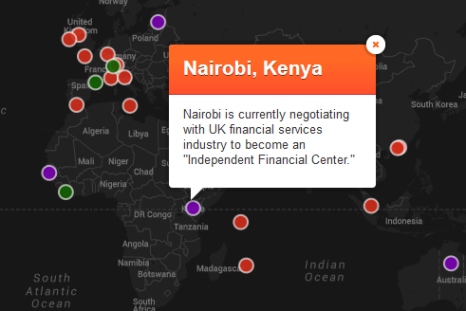

DeVere Group CEO Nigel Green wants the global financial reporting regime to be repealed, a call that has gained little political traction to date.

Russia has threatened to withhold aid from Ukraine until the country forms a new government.

New York City is fighting in court to defend its ban on large sodas in restaurants.

Natural gas in recent trading has reached beyond $5/btu, a threshold Citi analysts dubbed “unthinkable."

About 40% of online grocery shoppers prefer one high-profile company over the others, according to a poll.

Telling stat: Citigroup analysts estimated that existing platinum supply rose 95 percent over the past six years.

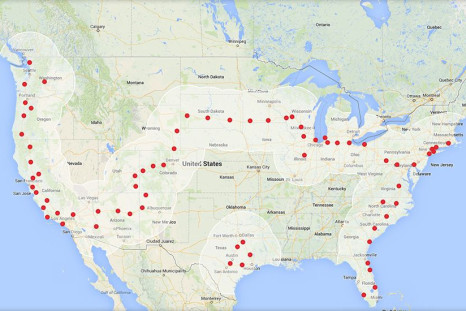

The father-daughter duo left from New York and headed to Los Angeles.

Social investor Harrington Investments Inc. has asked that Monsanto report on risks stemming from its GMO business.

Rep. Mark Takano has called for more oversight of rental-backed securities, a new financial innovation introduced by Blackstone late in 2013.

Cheap Chinese steel has led many U.S. traders to buy Chinese steel instead of U.S.-produced steel.

Gold prices will struggle to climb higher in 2014, according to EverBank strategist Chris Gaffney.

Editor's pick