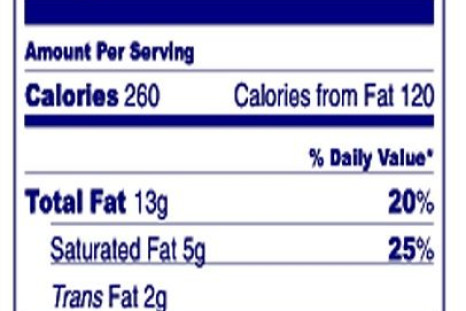

U.S. food regulators have taken steps to eliminate trans fats from most of the U.S. food supply.

Private equity firms are turning to real estate again after five years of recession, but they could have trouble cracking "gateway" markets.

The bank’s latest regulatory filings show a discrepancy between the second quarter and the current quarter.

A HSBC research note makes explicit what has become increasingly clear to gold investors this year regarding the gold market's most bullish factor.

The e-commerce giant has offered to sell Kindles at a discount to retailers, which can sell them to customers and get a cut of e-book sales.

Are the components of this economic recovery sustainable?

Key question: Can Twitter leverage its user base into above-average demand for its shares?

“Beaten-down” mining stocks are likely to remain unattractive until gold prices rise, which could take months or years.

The OECD said personal well-being deteriorated substantially, owing to the global economic crisis.

Outflows from gold-backed specialist funds totaled 48 metric tons, surpassing September and August combined.

The Catskills region in N.Y. state could see the most heated competition for scarce casino licenses if a referendum passes Tuesday.

Hedge fund manager Carl Icahn said in a statement that activist investors will help keep U.S. companies competitive on world markets.

Will Janet Yellen's ascension to the head of the U.S. central bank help to extend the current rally in IPOs?

The Belgian brewer moves to expand its already dominant global market share.

Big U.S. companies are seeking and finding lenders in a responsive corporate bond market.

Lower gold prices have yet to bring a fresh wave of bargain buying from China and India, whose investors may be turned off by the metal’s volatility.

Despite strong earnings overall, Starbucks’ financial summary for 2013 so far highlighted a tough year in Europe and other regions.

The major decision throws the world’s largest gold producer into even more uncertainty with respect to its overall mine plans.

Japanese pension funds remain healthy gold investors, according to the World Gold Council.

Does Russia's surprise buy in September mean anything for central banks' gold-buying in coming months?

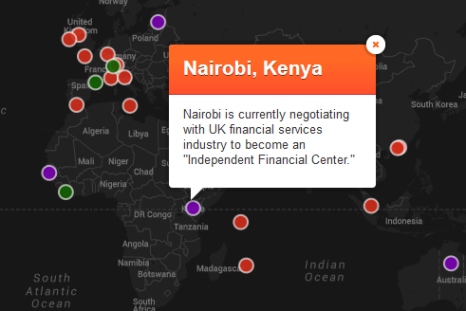

The 2010 FATCA law requires foreign financial businesses, like banks, to disclose substantial information about their U.S. account holders.

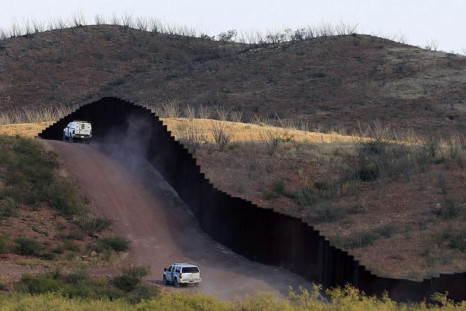

UBS economist Paul Donovan explains exactly how the financial crisis may have sparked anti-immigration sentiment in Europe and America.

Russia sold 12,000 ounces of gold in September, a move that may have surprised gold markets.

Single-malt Scotches have become more and more popular in the past few decades, with dominant U.S. makers now targeting emerging markets.

Indian investors take a renewed shine to silver after tricky gold import rules dampen consumer demand for the more popular yellow metal.

Gold jewelry stocks are unlikely to be replenished by Indian importers, who face burdensome new customs rules.

Coca-Cola has opened a new bottling plant in the key Hebei province.

Japanese lawmakers will probably submit formal legislation seeking to overturn a ban on casinos soon.

The letter says global gold demand is 1000 tons more than what council statistics say.

The public interest group is petitioning Mars to switch to natural dyes, claiming widely used artificial ones aggravate hyperactivity in some children.

Editor's pick