The fears over tightening credit supply are overblown, but it is also a reason for the Fed to pause its policy, the head of U.S. financial markets at Oxford Economics said.

The policy of both jacking up interest rates and pulling a massive amount of liquidity out at the same time is an absurd policy design, said Mike Cosgrove, principal at Econoclast.

Investment strategist Hugh Johnson told International Business Times that the stocks are undervalued and the S&P could close the year higher than current levels.

Analysts polled by International Business Times say the 2-10’s yield curve is not a reliable tool to indicate an upcoming recession, when the economy is doing strong.

Recessions are inevitable -- but they're also excellent buying opportunities for investors.

The soggy Asian start followed an uninspiring performance overnight on Wall Street where the Dow lost 0.2 percent and the S&P 500 shed 0.1 percent.

"I think it will be a great buying opportunity for U.S. assets, from Treasuries to high-yield 'junk' bonds," Prudential's Gregory Peters said.

Yields on Germany’s 10-year sovereign bonds plunged into negative territory for the first time amid concerns over a potential Brexit.

Polls seem to suggest the probability of Britain leaving Europe is rising, said Tatsushi Maeno, managing director at PineBridge Investments.

Goldman Sachs, JPMorgan and other major lenders reported dampened revenues after a quarter marked by global market volatility.

Sounding the alarm over instability in the bond market, major banks are asking to roll back rules that make markets more transparent.

The two banks reported quarterly results Thursday amid a busy week of corporate results from the financial sector.

Stronger regulations and tougher markets have forced big banks to slim down.

Profit at Goldman Sachs' bond trading business, traditionally a strong unit, plunged 29 percent last quarter due to multiple bouts of market volatility.

The losses that started Thursday are the start of a trip south for stock investors.

Salaries in the New York securities industry are almost back to their 2007 high.

U.S. Treasury yields registered their biggest increase in 30 months -- on sentiment that high unemployment will fall sooner than expected.

The Bank of Japan on Tuesday left its monetary policy unchanged but revised its outlook on the country's economy.

Many African countries are hitting the global bond market.

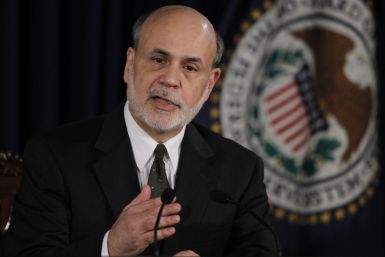

Thursday's announcement by the U.S. Federal Reserve that it would be engaging in a third round of open-ended bond-buying, known as QE3, to energize the economy saw a resoundingly positive reception in the foreign financial markets, where indexes rose Friday. But market-watchers were expecting the global equity party would lead to an inevitable hangover soon, in the form of intervention by central banks around the world, to stop massive inflows of dollars into non-U.S. economies -- in short, a...

Private sector deposits fell by nearly 5 percent in July to €1.509, European Central Bank data showed, as public confidence in the banking system continued to plummet amid a worsening economic situation.

Yesterday the Fed announced that they will extend their yield curve 'twisting'