The U.S. Congress passed new sanctions against Iran's oil and nuclear program on Wednesday evening, but Israeli officials remain unconvinced that the sanctions will have the desired effect.

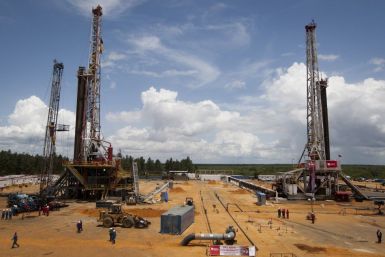

The financial situation in Iraq, one of the world's largest reservoirs of crude oil, has become grave.

Crude oil prices remained near $90 a barrel during Asian trading hours Tuesday as investors awaited the outcome of major central bank meetings later this week.

The week is chock-full with data releases that will confirm if the summer malaise continued in July. As always, Friday's employment report will carry the most weight. Another highlight of this week is the much anticipated Federal Open Market Committee meeting on Tuesday and Wednesday.

Crude oil futures advanced Monday as sentiment was buoyed on speculation that major central banks around the world would act to tackle the deteriorating global economic conditions.

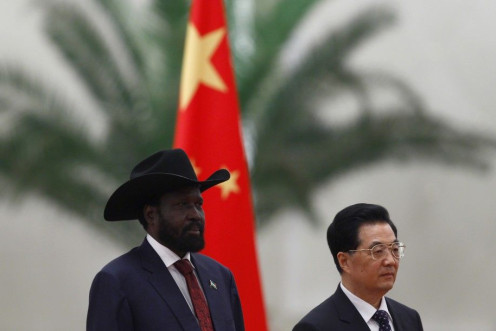

This time, China's bid is unlikely to be blocked by the government, as its attempted takeover of Unocal was seven years ago

Based on a median estimate among analysts polled by Thomson Reuters, ExxonMobil will report earnings of $1.96 a share on revenues of about $115.08 billion -- a decline of 8.3 percent from the year before. The company will post its second-quarter earnings on Thursday at 10 a.m. EDT.

Crude oil futures advanced Tuesday as fears over a sharp growth slowdown in the world’s second largest economy slightly eased after a report showed that Chinese factory activity in July grew at its fastest pace in five months.

In a fairly light week of data, Friday's first take on the U.S. second-quarter gross domestic product will be the main event. Economists expect a feeble reading of 1.4 percent. This will be the final major data point to influence participants at the July 31 - Aug.1 meeting of the policy-setting Federal Open Market Committee.

Spain's stock market plunged Monday to its lowest level in nearly 10 years on growing doubts that the nation can avoid defaulting on its massive debts without an external rescue. The government also instituted a three-month ban on short-selling all securities.

Crude oil futures plunged Monday as renewed concerns over the euro zone debt crisis weighed on the financial markets and commodities.

Crude oil prices advanced to a seven-week high Thursday, helped by firmer Asian stock markets and geopolitical tensions.

Nigerian authorities served Makoko residents with an eviction notice last week. They were given only 72 hours to leave their homes before demolition forces moved in.

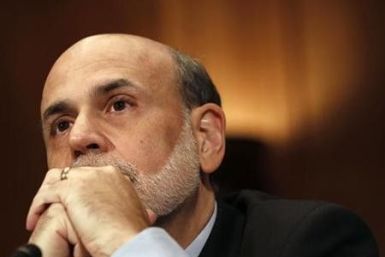

U.S. stocks gave back early gains and turned negative after Federal Reserve Chairman Ben Bernanke set out a downbeat view of the economy to Congress without promising imminent easing measures.

Gold prices rose towards $1,600 an ounce on Tuesday in line with the firmer euro as investors awaited a statement from Federal Reserve chair Ben Bernanke later, after soft U.S. data fuelled talk he may hint at fresh measures to stimulate the economy.

Crude oil prices slightly advanced Tuesday as investors awaited testimony from Federal Reserve Chairman Ben Bernanke for hints about further easing.

China's growth rate slowed for a sixth successive quarter to its slackest pace in more than three years, highlighting the need for more policy vigilance from Beijing even as signs emerge that action taken so far is beginning to stabilise the economy.

The IEA estimates world oil demand at 90.9 million bpd in 2013, and says fuel consumption in the developed economies of the Organisation for Economic Co-operation and Development (OECD) will be overtaken for the first time by non-OECD demand, a trend that is unlikely to be reversed.

Crude oil prices lowered slightly and hovered above $85 a barrel in Asian trade Thursday, as investors opted for caution ahead of the Chinese GDP data.

Newly released minutes of the U.S. Central bank's June 19-20 Federal Open Market Committee meeting were being taken by the stock market as indicating unwillingness to engage in further monetary easing.

The increased sale of American products in Europe and China, amidst economic turmoil in both regions, does little to evoke hopes of economic growth in the U.S.

The trade deficit in the U.S. narrowed slightly in May as exports to Europe and China rose, while import bill fell on cheaper crude oil prices.