Fiscal Cliff 2012: What It Means For Consumers

Washington can go right or left in the fiscal-cliff talks, but U.S. consumer spending will probably take a hit next year either way.

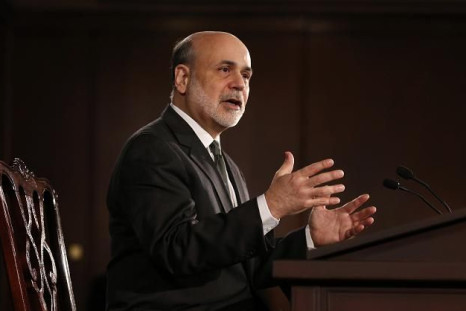

Fiscal Cliff 2012: What It Means For The Federal Reserve

Fed Chairman Ben Bernanke coined the term “fiscal cliff.” But he also said politicians need to act since the central bank can't do much.

ICE Makes $8.2B Bid for New York Stock Exchange Operator

Exchange operator Intercontinental Exchange (NYSE:ICE) said Thursday it was looking to buy the parent company of the New York Stock Exchange for $8.2 billion.

Besieged By Legal Liabilities, Criticism Of Sovereign Ratings Methodologies, Fitch, Moody's, S&P Face Rough End To 2012

Criticism of credit rating agencies continues after an analysis revealed their sovereign ratings lack reliability.

US Banks Seek Exemption From More Than Half The Capital Buffer Required Under The Basel III Global Rules Known As Basel III

U.S. banks are refusing to play ball on global capital rules, claiming they shouldn’t be forced to put more cash in a rainy day scheme.

In Visit To Gold Vault, Queen Questions Bank Of England Officials On Financial Crisis

In a visit to the Bank of England, Queen Elizabeth II politely but firmly questioned the precise reasons why the Bank never saw the crisis coming while other regulators did little to prevent it.

Egypt Poised To Fall Into Vicious Cycle Of Economic And Political Crisis

Egypt is at risk of descending into a cycle of economic crisis feeding into political crisis, as it had to delay asking for an IMF loan.

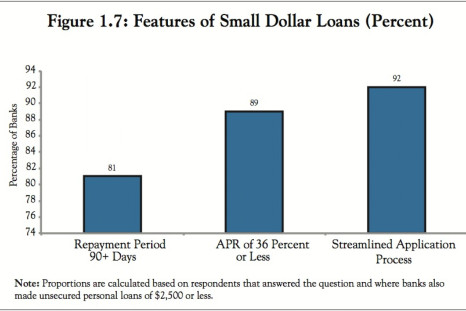

Despite Ultra-Low Borrowing Costs For US Banks, 1 In 10 Charge Ultra-High Interest Rates On Loans

In total, 11 percent of banks admitted they charge more than 36 percent annual interest on small consumer loans of less than $2,500.

European Leaders, Making Major Concessions, Move Forward on Banking Union

Key players in the continuing Europe debt saga and financial crisis announced what amounted to Christmastime gifts to Greece and Britain.

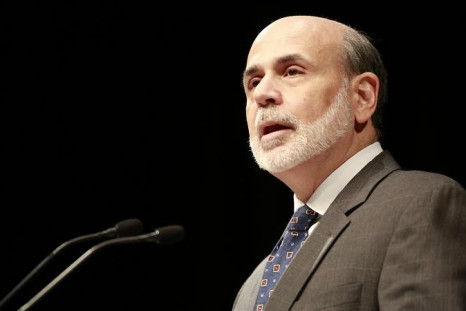

Bernanke Explains New Fed Guidance, Confusing Reporters and Self

The chairman attempted to clarify new guidance from the Fed, but the more things were explained, the more complicated they became.

Fed Links Future Bond Purchases To Unemployment, In Historic Move

The Fed Wednesday announced a new round of monetary easing and, in a historic turn, tied future actions to a numerical jobless target.

Mexican Stock Exchange Having Record-Breaking Month on Bank Strength, Economic Confidence

Without much fanfare, the Mexican stock exchange has been setting record after record this month.

Federal Reserve Seen Approving Further Quantitative Easing This Week As Fiscal Cliff Looms Large

As U.S. budget talks continue on Capitol Hill, the Federal Reserve is expected to announce a new round of quantitative easing Wednesday.

Ana Botella, Deeply Unpopular Madrid Mayor, A Study In Political Falls From Grace

Ana Botella appeared to be a hit as Spain's first lady eight years ago and seems to be a miss as Madrid's mayor now. What happened?

Megabanks Like Citi, Bank Of America, Barclays, UBS And JPMorgan To Do Well In 2013: Fitch

Next year should be a good one for big banks such as Bank of America, Barclays, Citigroup, JPMorgan Chase and UBS.

Greece Faces Off With Hedge Fund Investors Ahead Of Buyback Scheme

The ability of Greece to stay in the euro zone depends on how hedge funds respond to a critical debt swap.

At Press Conference After ECB Interest Rate Decision, Draghi Faces Frustrations and Mistrust

ECB President Draghi faced a hostile reception at a monthly q-and-a session, as the media pressured him on Europe's economic woes.

PIMCO's Investment Co-Chief Bill Gross Sees 'Seven Years Of Lean' For US Economy

Bill Gross, the manager of the United States' largest bond fund, was out Tuesday with a very dour view of the U.S. economy.

After Practical Joke In Major Policy Poll, Politicos Take To Twitter To Poke Fun At Clueless Respondents

A practical joke played on Americans by major pollster PPP led to a string of Twitter comments by politicos: Americans' issue awareness was not high.

Despite Monster Rally, Euro Weakness Against The Dollar Obvious In Swap Rates

Despite ballooning exchange rates, investors can’t get rid of their euros fast enough, as various rate indicators are demonstrating.

Red-Letter Day In Greek Crisis As Bond Buyback Advances, Merkel Eases Germany's Stance On Future Losses

Monday: a very good day for Greek crisis resolution. But again, the onus of solving the problem fell on taxpayers, and spared financiers.

Spain, EU Announce €37 Billion Rescue of Banking System

Both the Spanish central bank and the European Union announced Wednesday the details of the financial sector rescue.

Carlyle Seen Selling Remaining Stake in Chinese Insurer: Credit Suisse

Credit Suisse said another big divestment was coming to the Asian insurance market.

Workers Wasting Time Cost US Employers $134B In Lost Effort: Infographic

Employees waste enough time on “non-work tasks” to cost their employers some $134 billion in lost productivity.

Bombardier, VistaJet Agree On Massive Order

Canadian aircraft manufacturer Bombardier, Inc. signed its biggest deal ever Tuesday, when it accepted an order potentially worth $7.8 billion from London-based luxury charter company VistaJet.

Cyber Monday Bigger Than Last Year, Starts Earlier, Lasts Longer.

The migration of shopping to virtual storefronts was in full display on “Cyber Monday,” the biggest online shopping sale day of the year.

Argentina To Battle Claims From Hedge Funds In US Court After Legal Setback

A messy legal fight over the fallout from a 2002 sovereign debt restructuring came to a head last Wednesday and was expected to enter a critical phase over the next three weeks.

Thousands Of Egyptians Protesting President Morsi Following Latest Decree; Hundreds Injured

Tens of thousands of Egyptians began demonstrating Friday, a day after the president issued a decree expanding his office’s powers.

Study Finds Adults Medicated For ADHD Have Lower Crime Rates Than Others

A new study suggests that adults treated with stimulants for ADHD are less likely to be imprisoned than those who aren’t.

German Nonprofit Proposes Alternative Rating Agency Model That, Not Surprisingly, Rates Germany AAA

A nonprofit sovereign rating system was proposed in Germany as an alternative to the current system, a day after Moody’s downgraded France.